(Editor Note: Insight Bytes focus on key economic issues and solutions for all of us, on Thursdays we spotlight in more depth Solutions to issues we have identified. Fridays we focus on how to build the Common Good. Please right click on images to see them larger in a separate tab.)

Photo: calwatchdog.com

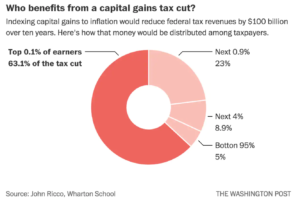

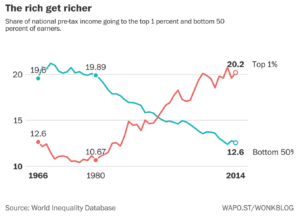

The IRS was tasked after passage of the Tax Bill last winter with defining which businesses and owners would qualify for a special 20 % deduction on pass through income. Interpretations of the pass through 20 % deductions where announced yesterday. As maybe expected the law favors the rich, and even gives the Trump Organization new benefits which the president can take advantage of as he still holds title to his businesses and properties while in office.

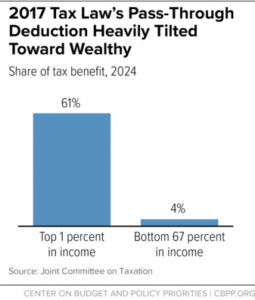

Half of all U.S. businesses use pass-through income structures with 70 % of the income flowing through to the top 1 % in wealth.

Sources: Joint Committee on Taxation, Center on Budget and Policy Priorities – 5/10/18

The tax bill provision for pass through deductions builds on a tax law that is already biased toward the wealthy who own businesses structured to maximize tax benefits. The Center on Budget and Policy Priorities (CBPC) notes due to a byzantine design opportunities for gaming are rampant, “ it could wind up being even more expensive and delivering larger tax cuts to high-income filers than current estimates show because it creates a significant gaming opportunity: high-income individuals may now be able to secure very large tax savings by converting their labor income into pass-through income to take advantage of the new deduction.”

The CBPC estimates that over $50 billion will be lost in tax revenue each year for the nine years the law is in effect for a total of $450 billion of the $1.5 trillion deficit from the bill. When the law was written arbitrary winners and losers were chosen for example excluding architects and engineers. New York University law professor David Kamin observed in recent congressional testimony, “This pass-through deduction represents the very worst kind of tax policy, picking winners and losers haphazardly in a complex tax provision, and then generating significant incentives for people to rearrange their businesses to try to get on the right side of the line.”

Next Steps

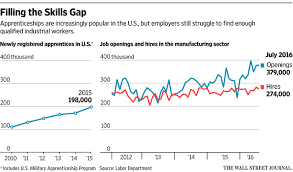

We have consistently noted that the Tax Bill of 2017 favoring the rich with 80 % of the tax benefits will torch taxpayers to the tune of $1.5 trillion deficit to be financed by bonds. This abusive blatant giveaway to the rich is a disaster both in terms of income equality and economics. Our generation and many generations to come will be paying off bond interest instead of investing funds in education, infrastructure projects, job training, Heartland initiatives, medical care and apprenticeship programs. The bill needs to be repealed, applying taxes to corporations and the wealthy to invest in programs that benefit the 80 % not the top 1 % in income.