(Saving Democracy Series: this post focuses on what factors are causing labor to lose it rightful position as an equal partner with capital in the US economy and concludes with ideas on how to bring labor back into an equal role; from new institutions like a Federal Reserve for Labor, to corporate law reform, ending stock buybacks, and training with a powerful apprenticeship program)

Labor has been viewed as a cost for hundreds of years. Somehow the early accountants working for Middle Age Venetian families invented double entry accounting systems with debits and credits, These accountants called credited assets like money, land and equipment while labor was a debit labeled as an expense. Labor is viewed as an expense to this day because the owner-entrepreneur has to pay employees to work – in effect ‘renting labor’.. Workers have had the ‘cost’ yoke around their necks ever since. Yet, are employees really a cost? The staff are the ones doing the work, creating the product or service and solving the problems – money does not create the product or service only people do. CEOs are often heard to say that employees ‘are our most important asset’ but then treats them like second class citizens in making policies for the company, gaining a fair share of the profits or enjoying job hours flexibility. Today, Wall Street applauds wages being stagnant for the 80 % while profits go up while wealth accumulates for The Elite.

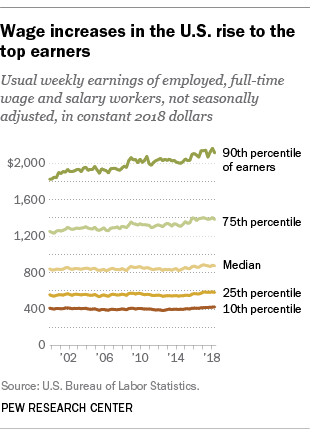

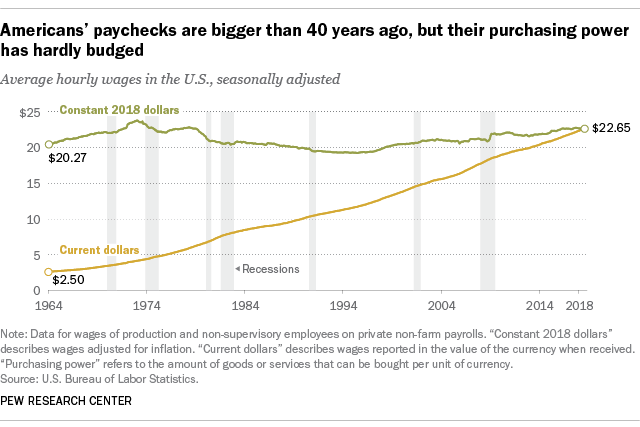

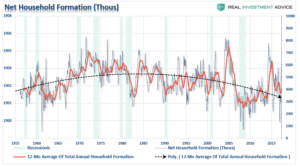

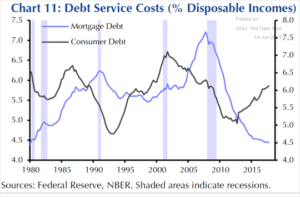

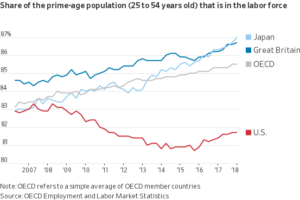

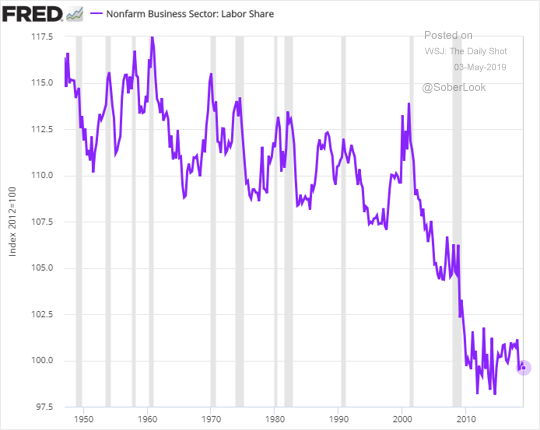

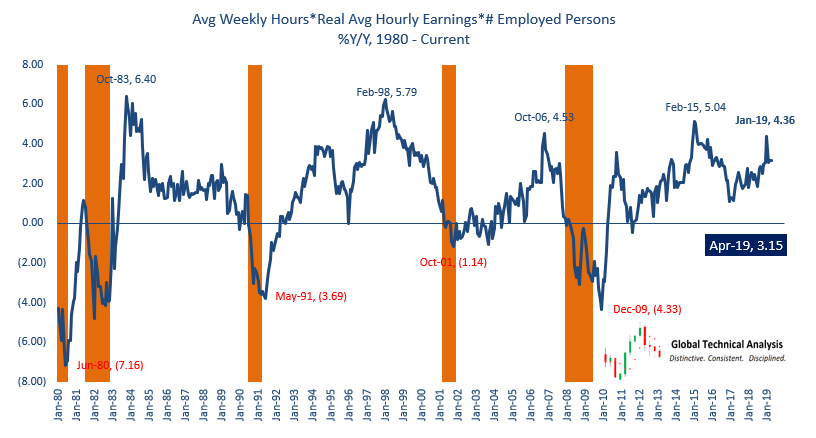

Over the past 20 years in particular, workers have seen their ‘economic position’ continue to deteriorate. Labor sovereignty continues to decline on multiple fronts: wages, benefits, standard of living, job negotiating clout, choice of companies and the constant sword of Diogenes held over their job by automation. For example over the past fifteen years wages for workers have been stagnating. However, this declining wage trend is not new, it has been happening since the early 1980s, when President Reagan took office and ‘trickle down economics’ was promised as a way to give workers a fair share of the economic pie. Workers have lost their wage share of business sector income ever since.

Labor’s share of business sector income has dropped by 15 % since 1950. While, this labor share statistic uses wage employment data and estimates for self- employment, some observers think the decline is largely due under estimates of the size of the ‘gig economy’. However, separate wage data supports the declining wage trend:

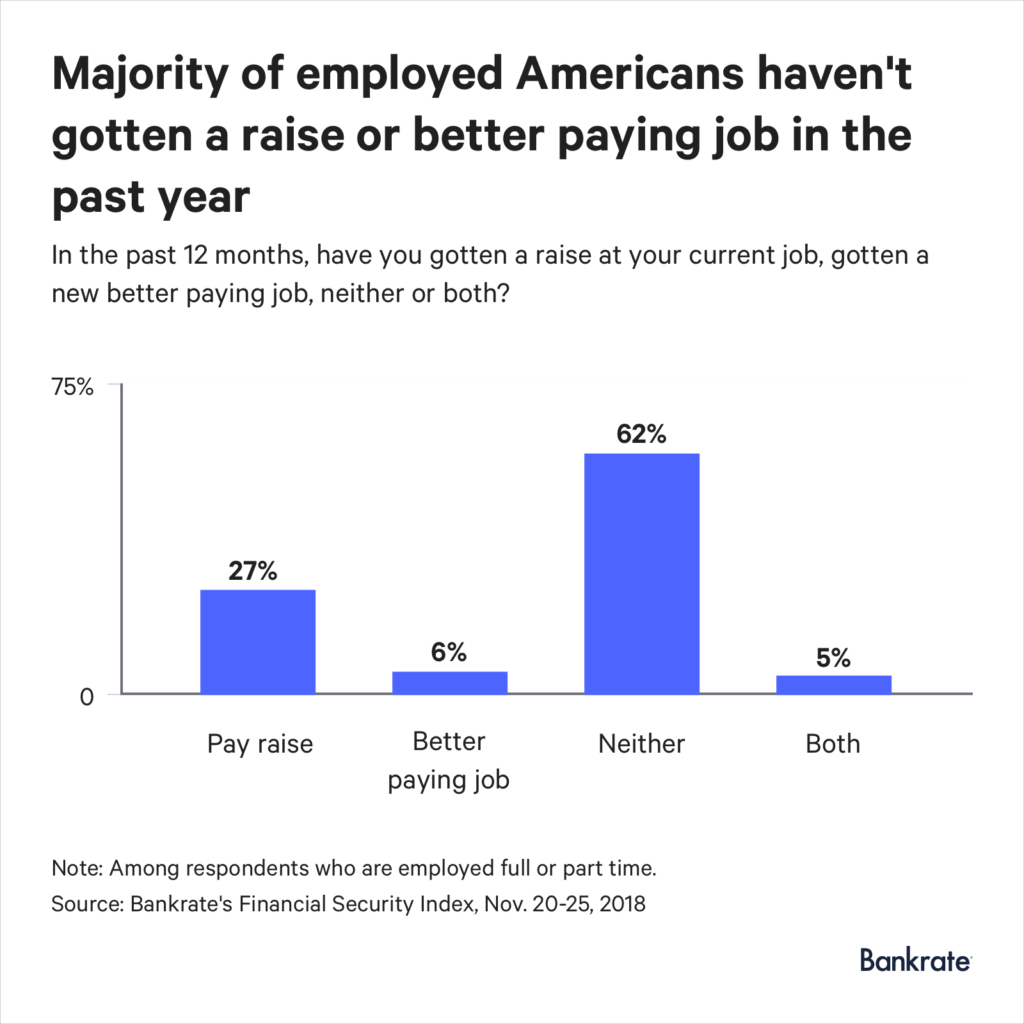

When real wages calculated after inflation are allocated across all employed workers the decline is most apparent, a 34 % decrease since 1983. The softening wage trend is not getting better, Bankrate surveyed 1,000 workers last year and found that only 27 % received a wage increase.

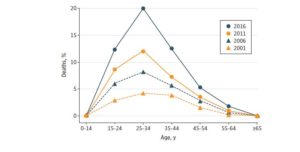

Why have wages continued to fall the past 50 plus years? There are multiple factors combining to put workers at the lowest point of wage negotiating power in recent times. Automation is one of the prime reasons for the loss in wage bargaining power.

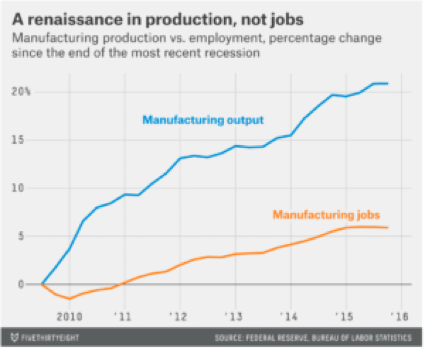

Almost 5 million manufacturing jobs have disappeared since 2000, yet over the past 9 years factories have been coming back to the US by increasing employment by 5 %, but with far fewer workers. Yet, the US is taking the No. 2 position in worldwide manufacturing output with a 20 % increase in output

The reduction of manufacturing jobs in the US, automation has been a key factor weakening the worker wage bargaining position. A recent Ball State University study found that over 88 % of lost manufacturing jobs were due to automation and productivity increases not offshoring.

Automation started decades ago, as IT applications deployed in offices and manufacturing plants in the 1970s and 80s displaced thousands of workers performing repetitive manual tasks such as data gathering and reporting, answering phone calls, editing and copying documents, sending and receiving status reports, manufacturing reporting and others that were easily automated by software. By 1995, the Internet began to impact the workplace, networking software applications so that jobs once requiring local support or data could be performed overseas for far less. In Silicon Valley, an entry level software engineer would be paid $65 – 75 @hr., while an engineer in India was paid $20 @hr. or less. Thus, most business processes for ‘non-core’ functions like accounting, IT, customer support and benefits processing were moved offshore to reduce costs by 50 – 75 %.

In addition, major corporations have been outsourcing non-core services to US contracting companies to the detriment of worker’s pay security or benefits. For example, in Silicon Valley starting in the 1980s until present – many core IT functions were outsourced with ‘facilities management’ agreements, where IT workers are fired, and rehired by outsourcing companies at 30 – 40 % less in salary with no benefits or health insurance. The workers were faced with no good choice – look for another job or take a pay and benefits cut for the job they had before. In the Bay Area, H1-B visas are often used to keep wages low by offering a worker from India 40 % of the local prevailing wage for a software engineer. The present GOP Administration has significantly reduced H1-B visas by a ratio 1 accepted of every 4 applications the lowest rate in 10 years.

Automation investments continue as software firms develop applications that automate many business activities previously thought to be difficult to automate:

Jobs requiring skills from sensory perception fine motor activity or navigation are going to be automated over the next 30 – 50 years. All this investment in automation results in less competition for employers to find employees to do the work they need – a machine will do it. The machine shows up on time, requires no vacation, is not absent, and does not sue the company for management miscues. Plus, the added benefit is in well implemented automation projects costs are driven down, profits up so executives see their compensation increase.

Corporate Oligopoly

Another way corporations limit worker job options is by merging with other companies and then laying off workers in the newly combined firm. Since 1997 the average market share for the top four firms in most of 893 industry sectors has increased from 26 % to 34 %. For a tenth of these sectors where the top four firms have 33 % to 66 % market share their revenues have increased by 37 %!

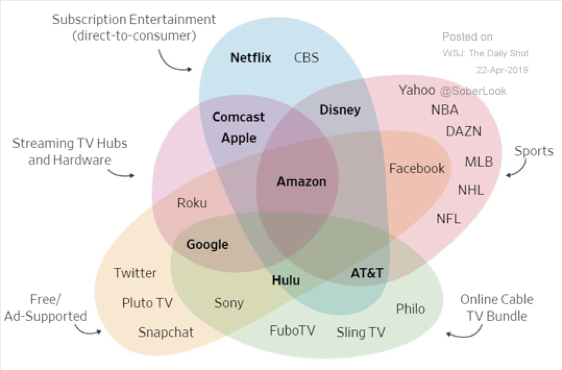

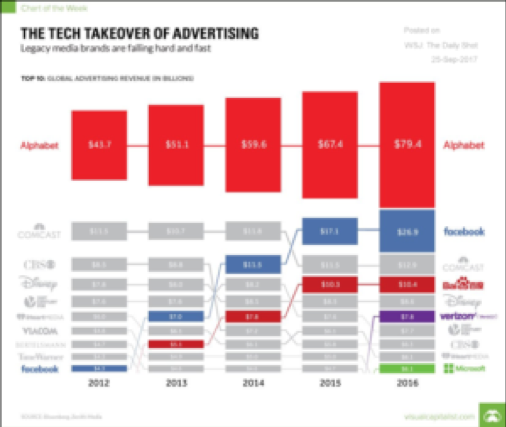

The antitrust section of the Department of Justice has been asleep the past two decades. In the airline industry, there are now 4 airlines that own 80 % of the business. In finance, just 5 banks have 50 % of $15 trillion in total assets. In the information search sector – the top 4 companies have 98.5 % of the search industry market. The wireless communications industry is dominated by the top 4 companies control 94.7 % of the market between them – Verizon, AT &T, Sprint and T-Mobile. In the tire manufacturing sector, the 4 top firms dominate the US market with a total market share of 90.1 %. In 2012, entertainment, media and distribution markets were concentrated in 6 conglomerates with a total of 90 % market share. In 1983, 90 % of entertainment and related markets was distributed over 50 corporations, this chart sho concentration in the fastest growing streaming markets:

The advertising industry has consolidated into a two Internet behemoths – Google (Alphabet) has nearly 50 % market share and Facebook with 16 %:

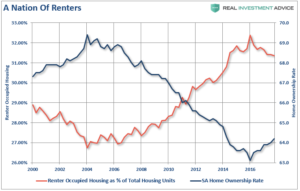

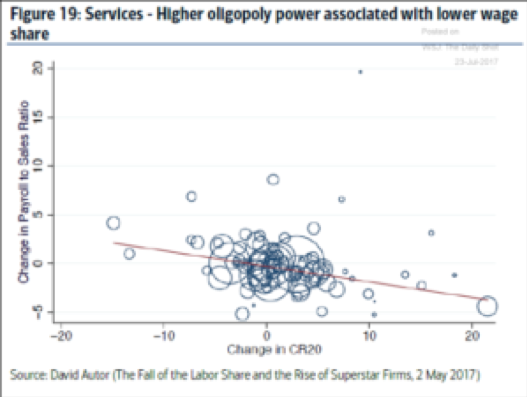

From 1997 to 2017, the number of publicly listed corporations has declined by 50 % overall. Fewer corporations for job candidates translates into fewer corporations offering good paying jobs with high quality benefits. Plus, an analysis of corporate concentration in the five year period of 2007 to 2012 in the services sector, found that where corporations control markets and reduce the number of workers to support sales wages are likely to decline.

Gig Economy

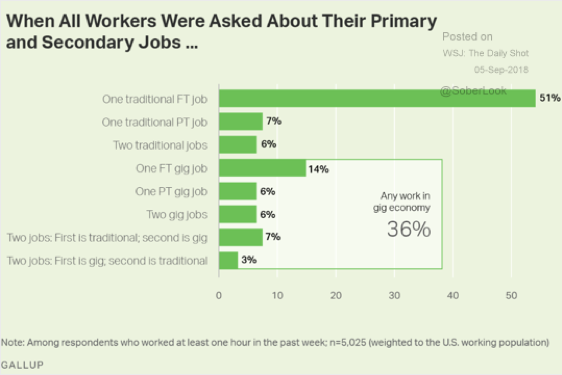

The ‘gig economy’ of freelancing and independent contractors has ballooned to about one-third of our workforce or 56 million workers in 2016 according to the McKinsey Global Institute. A survey by Gallup indicates the types of gig jobs; full-time gig job, part-time gig job, two part-time gig jobs, one traditional job and one gig, or where the first job is a gig and the second job is a traditional job for 36 % of the the total workforce:

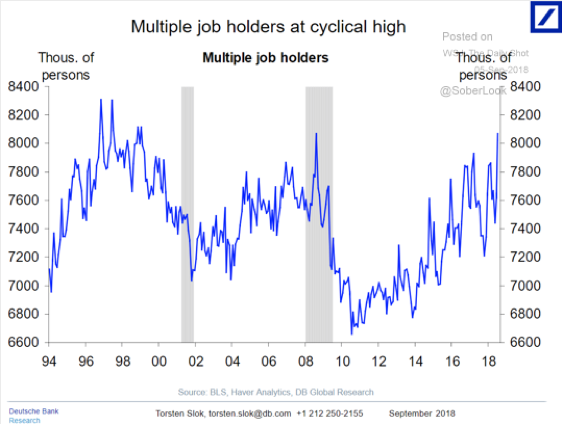

Workers in the bottom 80 % in income have seen their wages actually decline over the past 10 years. So, it is no surprise middle class workers need to hold at least two jobs to maintain their standard of living. The number of workers holding multiple jobs has skyrocketed in the past few years to the highest level since 2008 (note the recessions at the peaks of multiple jobs).

When major corporations experience a slowdown in sales, as has occurred in the last quarter, temporary and gig workers are the first to be laid off or see their contracts cut back along with rates.

The growth of ‘shared economy’ companies like Uber, Lyft, Lime, Airbnb, VRBO and many others have provided these gig workers new flexible income opportunities without the financial safety net of traditional employer jobs. Gig economy workers often have limited or no access to worker’s compensation, unemployment insurance, 401K retirement plans, disability insurance or health insurance. Independent workers are required to pay both the worker and company portion of Social Security taxes and worker portion of Medicare each year on their income. In the Gig Economy, 33 % of our national workforce is not organized into a union or any bargaining unit. These contract workers are at the mercy of corporations or businesses that set the terms of a work contract, and if there is a problem they quickly find another contractor with no obligation to the contract worker. Uber, and Lyft dominate the ride sharing market, pushing out taxi cab firms, car companies and shuttle businesses – many with full time employees including benefits. While the cost of rides maybe going down for the passenger, workers are seeing their wages held steady or reduced (Uber reduced driver share of fares by 20 % a year ago) with estimates of an hourly wage ranging between $8.55 to $10.00 per/hr by Stanford researcher, Stephen Zoepf. Drivers receive no compensation for gas costs, auto depreciation, car insurance, Medicare and Social Security – paying both personal and self employment, car repairs and or financial protections. Uber and Lyft receive fees ranging from 25% to 39 % of fare totals. Drivers do receive tips. Financial protection for gig economy workers is in the infant stage, where companies are holding off any meaningful changes until class action suits are brought against them. Last March, Uber settled a suit filed by drivers from California and Massachusetts to be declared employees. The suit settled for $20 million to the drivers, without changing their employment status which stays independent yet they will be given more transparency on driver deactivation and a chance to purchase shares in Uber’s coming IPO.

Uber’s public stock offering demonstrates the gross inequality of income and wealth, as the drivers are providing the service, yet only a few drivers were offered stock options and the founders made billions of dollars from the public offering. The IPO is a good microcosm of how the Silicon Valley economy works rewarding a few while others providing the services or making products gain very little compensation in comparison.

Productivity

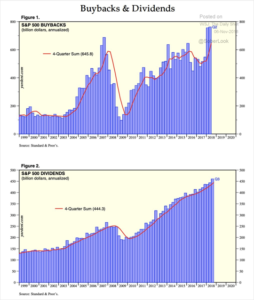

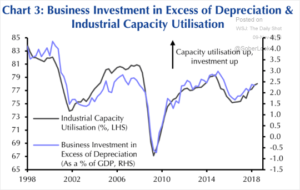

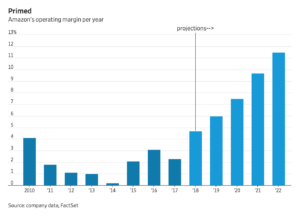

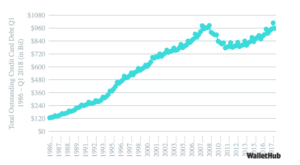

In 2018, Goldman Sachs estimates S & P 500 corporations will spend over $1 trillion in stock buybacks, and they forecast a similar figure for 2019. None of these funds are being invested in the business to develop new technology, processes, training or systems to increase productivity or cut costs. Business executives are using stock buybacks to goose the price of their stock artificially adding to their compensation packages and the stock returns of shareholders most of which are in the top 1 % in income. Essentially, management is robbing workers of increases in future wages due to the nearsighted allocation of funds to take care of them themselves and pander to the wealthy.

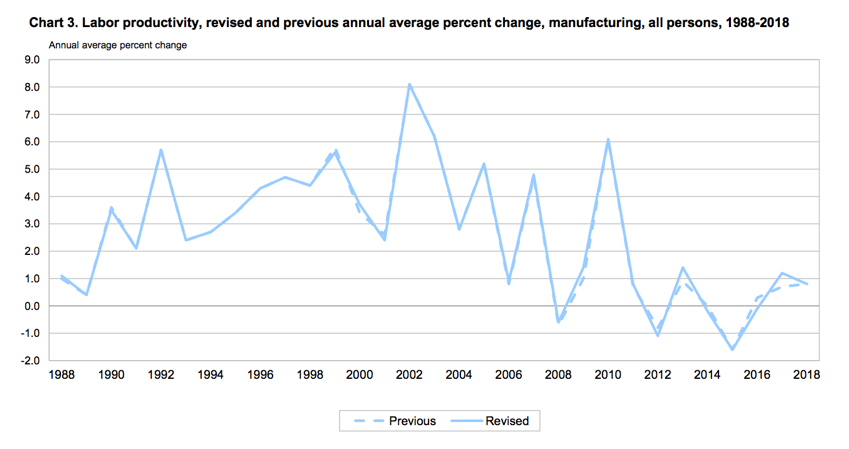

When productivity is anemic, offering wage increases to workers cuts into profits. Executives are compensated well based on hitting profit targets, so wage increases are not going to happen other than low inflation level 1 – 2 % increases. Over the past nineteen years manufacturing productivity has dropped from 8.0 % to 1.0 % this past year.

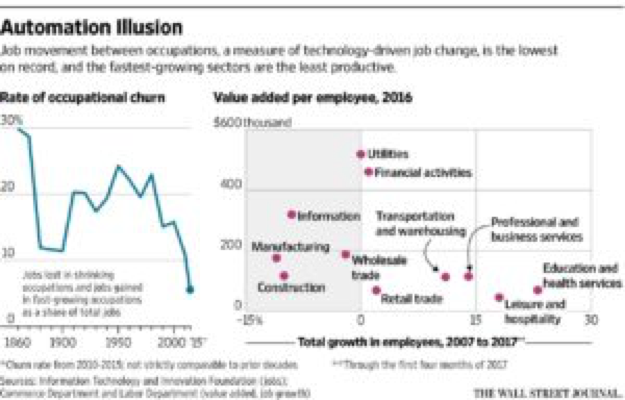

Most of our economy is services based, and productivity improvements in the services sector have been slow in coming compared to the goods based sector. For example in social assistance, education, and healthcare there has actually been a reduction in productivity by about 9% since the 1980s. Plus, hiring has centered on our services sectors so productivity increases are likely to be limited into the future. Our fastest growing sectors in the economy are among the least productive. Artificial intelligence and software services may change this trend, but the results are still to be seen.

Job changes are the lowest in the least productive services sectors, indicating work to be done to automate or implement productivity systems in these services sectors.

Executive Pay

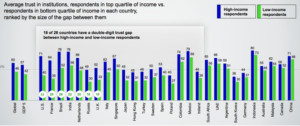

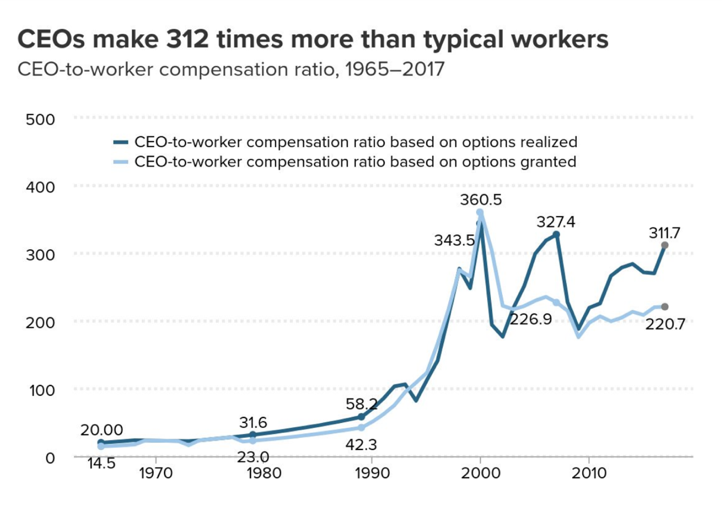

Today, executive compensation at S & P 500 corporations is on average 300 times the average pay of their workers! Senior management enjoys a combination of high salaries, executive healthcare, house low cost loans, stock options and bonuses for achieving earnings targets (hyped by stock buybacks). In 1975 CEO pay to mean employee pay was 25:1, in 1995 112: 1 and in 2017 312:1.

Note the ratio of CEO to worker pay soars in the 1990s as a result of the the de-regulation, trickle-down and stock buyback allowance policy of the Reagan – Bush administrations. Extreme executive compensation is taking wages from workers who would otherwise receive their fair share wage. Corporations have committed over $1 trillion to stock buybacks, according to Goldman Sachs in 2018 which only go to increase their stock compensation plans and the top 1 % who own most stocks. That trillion dollars could be better allocated to increasing worker wages so the economy works for the 80 % in income.

Worker Compensation

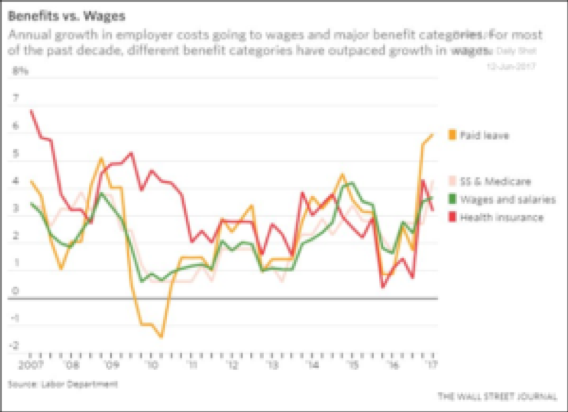

One aspect of worker compensation that has increased by 12 % since 2006 is total worker compensation in the form of benefits. While wages have increased by just 4 % in the same period. Paid leave, health and other benefits have grown faster than wages, except in a few months. Wages as a percentage of total compensation have dropped from 70 % in 2006 to 68.3 % in 2017.

The health component is somewhat misleading, while corporations have seen increased costs for medical coverage, they have reduced those costs by moving the majority of cost increases over to employees. Corporations have done this by increasing the deductibles covered, reducing the number of plans and increasing premiums. Worker households are caught in a cash squeeze by having to pay more for the health care coverage they had previously while corporations are holding their costs in line with inflation or slightly more.

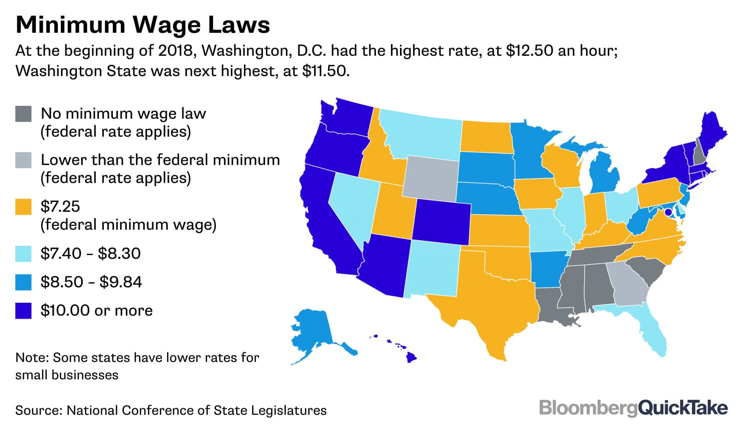

Federal minimum wage laws are not keeping up even with inflation. Some states are making up the difference, by requiring higher minimum wages than the federal minimum wage (dark blue, blue and light blue). Other states offer the same minimum wage (yellow) and yet in the South many states don’t have any (dark grey) wage minimum laws with others (light grey) below federal minimum wage rates like Georgia and Wyoming. Note many foreign car manufacturers have deployed plants in no minimum wage states like Tennessee, Alabama and South Carolina.

Job Market Automation

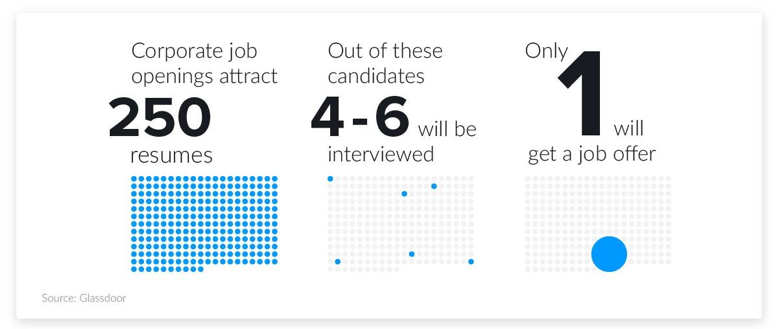

LinkedIn was designed for corporate recruiters with the features and services they wanted to speed the recruiting process. The edge to recruiters is obvious in the design of the service. For example job seekers cannot have multiple resumes or experience sets styled toward different jobs. Unless the candidate – user is adept at settings updates to profiles are immediately sent out to all people in their network. Recruiters have dashboards with filtered candidate lists around search preferences and locations. The majority of LinkedIn’s revenue is from the corporate recruiting market – candidates are promoted to meet the needs of recruiters. The use of LinkedIn, Monster, Indeed and other Internet job search services create and sustain a powerful recruiting edge for corporations. Businesses can identify hundreds of high quality resumes and candidates quickly from all over the world in just a few hours or less.

Resume scanning programs (recruiting bots) further refine the candidate list, filtering content by keywords, phrases or other text targets. Candidates are left with the challenge of figuring out what keyword ‘hits’ the bot is looking for and entering them into their resume so their resume will have the most ‘hits’ and rise to the top of the list of 250 plus candidates. Job seeking workers try to promote their job skills and experience with workers via social media sites, but are caught between being too public in their search with their boss finding out, or tipping off other candidates to the job they are seeking. Employers use their vast recruiting power in salary negotiations (‘we can always go to plenty of other qualified candidates’) and even after hiring keep all those candidate resumes online to fill the position if the new worker does not meet expectations. Only executives get promoted by an executive recruiter paid by corporate HR departments for find the right executive for an open position, once again the executives get a powerful edge over all other workers.

HR departments often hide behind Internet screens, offer no phone contact numbers and provide few ways for candidates to follow up with key staff. Often, the trend now is to interview a candidate and not get back to them after the interview if they aren’t interested – sending a de facto message of ‘if we were interested we would send you a message or call’. Without an inside contact, a candidate is left to be a cog in the corporate recruiting machine.

Unions

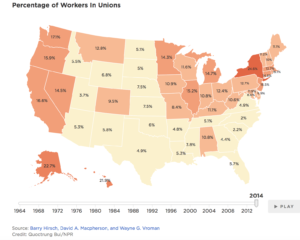

When the manufacturing sector had the majority of American jobs, union power in representing employees was paramount. Unions are still a key bargaining entity for public employees, nurses and teachers. U

Fifty years ago 33 % of all US workers were members of a union, by 2015 membership had declined to just 10 % – a greater than 66 % decline. The decline was quite pronounced in ‘right to work’ states in many in inland regions and the South:

Unions played a crucial role in working to raise wages, benefits and ensure that people worked in safe conditions. Due to automation and offshoring the manufacturing sector has lost millions of jobs, thus unions and their role will need to evolve to the new services technology based economy.

In summary, workers are faced with a daunting set of economic forces holding their wages down – diminished bargaining units, the juggernaut of automation, stock buybacks instead of wage increases, fewer jobs at merged corporations, temporary jobs in the gig economy, reduced productivity, exorbitant executive pay and corporate control of job markets.

To make our democracy work, labor needs take an equal place in our government, corporate and social structure with capital. Democracy = capital + labor where capital and labor have an equal political, economic and societal position.

Next Steps:

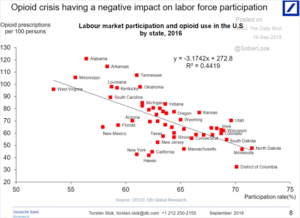

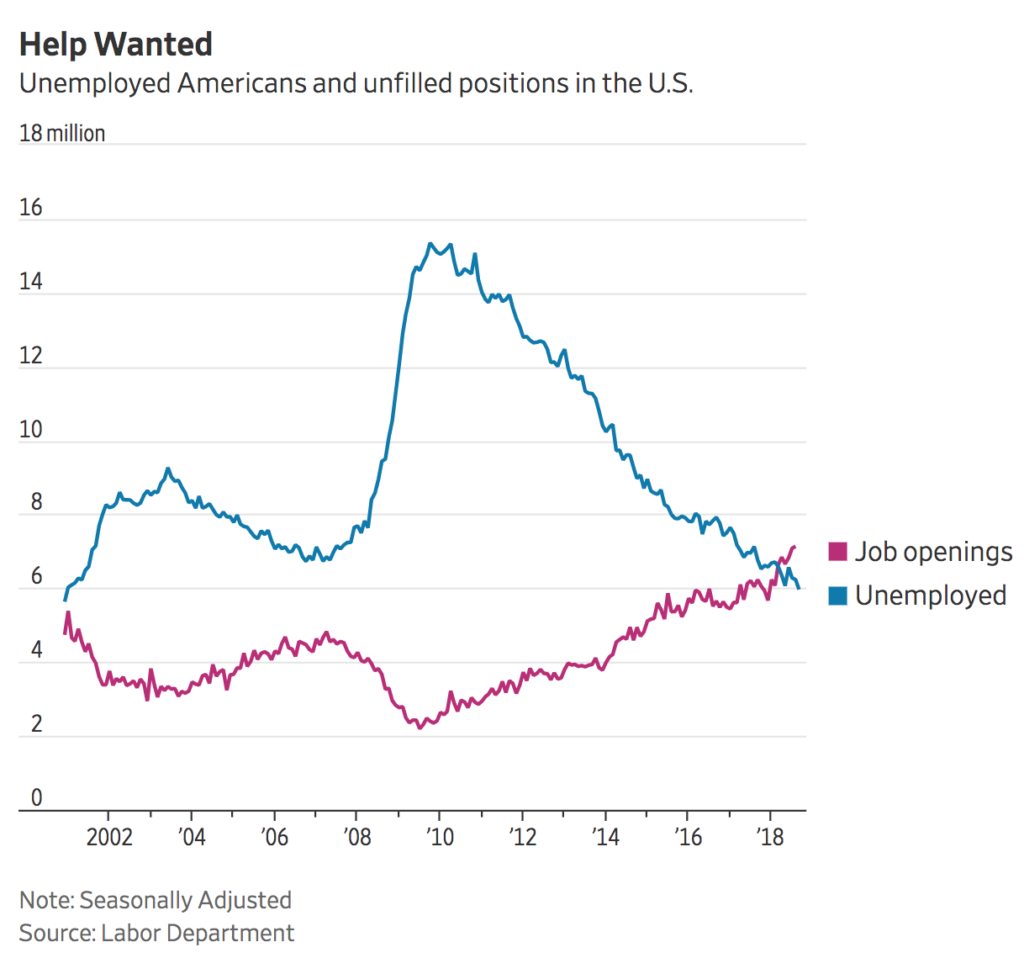

Federal Reserve Bank of Labor – the Federal Reserve system of Governors represents the nation’s largest banks with the President appointing each Governor. The system has worked well for the banking system to manage financial crisis’s and interest rates. The business community and national policy makers await a continuing stream of reports and the Beige book on the status of business throughout the 12 regions with baited breath. The Federal Reserve made up of 12 governors from regional banks, do not represent workers, or really have the tools, levers or policy role to solve labor problems. The Fed’s real mission is to ensure that banks stay viable and the financial system is sound. Yet, Congress charted the Fed with a dual role of keeping inflation in check and supporting full employment. Using the unemployment rate as an indicator of labor’s health is a mistake. The number does not include the millions of workers who have quit looking for work, those without the skills, or those possible workers who are suffering in the drug epidemic because of despair in part from lack of work. The miss match between the millions unemployed vs job openings is a huge challenge and needs to be undertaken by an organization lead by executives from labor focused organizations.

Labor needs an equal organization to represent labor at the table with capital. The new organization would advocate, collect research, and make decisions to promote the welfare of workers, improve wages and lead efforts to fill U.S. job openings. The mission of the Federal Reserve Bank of Labor (FRBL) is to ensure the United States has the most competitive, up to date skills in a labor force to fill all positions that US corporations have open. In short, the FRBL is in charge of the Labor Bank. The Federal Reserve of Labor would match the 12 regions of the Fed, would be composed of 12 Governors selected by the President from academia, corporate human resources, unions, government worker groups and worker rights group leaders to guide labor policy and programs for the country. The Governors would meet monthly, setting minimum wage rates by state in the country, review the results of labor statistics, write a Lavender report on the status of labor in each region, with a focus on putting unemployed workers who are seeking work back into the labor force and target an increase in the national labor force participation rate. The Governors establish interest rates and the size of allocated loans from a bank of $100 billion in labor development loans which are allocated to corporations, NGOs, Unions, universities and others to drive the development of the labor force. The Governors establish the Federal Minimum Severance rates by industry sector state, executive, manager and worker. A minimum severance rate is the proportion of salary received in severance for example 3 months salary. The FRBL board drives research into issues like why so many workers are still unemployed even with the unemployment rate being at a 50 year low, and why wages have stagnated over the past 20 years. The FRBL is charged with upgrading our labor indicators to assist policymakers in what is really happening to our labor force by industry, job type, racial group. The Governors are chartered to establish a labor force set of goals that are updated by month to measure the results of labor force development, both qualitative and quantitative. Labor experts in the Fed would move to the FRBL, coordinate surveys and research with Census and Labor departments. The Federal Bank of Labor Governors meet quarterly with the Fed Governors to coordinate capital and labor development plans and programs. Regional FRBL and Fed Governors meet monthly to coordinate regional programs.

In addition to building the FRBL these policy initiatives need to be implemented or similar:

- Place Workers on Boards – as Germany has so effectively setup, engaging management with required representation of workers on Boards, through Worker Councils or Unions if so voted by the majority of workers.

- End Outsourcing – corporations would pay 50 % tax on each job moved overseas making the move costly, encouraging corporations to move jobs to low cost or inland areas of the US, or innovation economic zones (special tax geographies) and to invest in worker training to receive training tax credits.

- End Low Cost H1-B Visas – the practice of importing inexpensive labor to drive down wages in US markets would be ended

- Focus Repatriated Funds on Labor – profits parked in banks overseas are invested in productivity programs, increasing wages of workers (not executives), reducing costs or innovation research. Stock buybacks or dividends would be prohibited

- End Stock buybacks – these funds are totally wasted, mislead investors on earnings reports and only serve to increase compensation for executives and shareholders. These funds are better allocated to increase worker wages or increase productivity so workers can receive higher wage increases

- Breakup Oligopolies – breakup market concentrations in key sectors: information technology, banks and financial services, health insurers, airlines, hospitals and clinics, entertainment, media and distribution and others as deemed in the public interest

- Balance Job Market Process– require companies over 100 employees to offer information on their website for contacts, phone numbers, job listings with identified contacts, and to let the candidate know the status of his consideration, and candidate introductions held monthly for F2F communication

- Balance Worker and Executive Pay– Empower Work Councils and labor representatives on Boards to approve all executive pay packages. Work Councils in industry sectors would meet and decide on executive to worker ratios of average salary to enable all companies to remain competitive within an industry yet require labor approval. End golden parachute packages by taxing 50 % of every dollar received above $1 million. Severance packages for workers would have to be in proportion to the highest executive package ie, executive receives a minimum of X dollars in proportion to total salary then a worker receives the same portion with a minimum of 50 % of their yearly salary or the Federal Minimum Severance Rate whichever is greater

- Fund Worker Training related to Robots and Increase Wages – for each robot employed, the corporation would be required to offer training, skills development for the displaced worker to find a comparable job within the company or outside. Where automation software or technology is deployed 10 % of the realized cost benefit would be used to raise the wages of all workers in the company. Tax deductions of up to a 50 % credit would be offered on the cost of training and development programs. For individual workers, if they pay for career development training they would be able to deduct the full cost of their investment in themselves from their taxes.

- Fund Education and Apprenticeship Programs – Representative Ro Khanna has introduced an idea to fund a 21st century Morrell (1862 Land Grant) Act that would grant to 50 rural and urban universities funds to establish a United States Technology Institute where students would gain technology skills needed in a technology based economy. In addition, our country needs a stem winding apprenticeship program patterned after the German model to bring skills needed for today’s manufacturing without a college degree. The program would be given the same prestige and recognition as college programs, companies would pay the same wages, benefits and compensation for skills achieved in this program as any college skills program.

- Pool Stock at Public Offering to Workers – all drivers at firms like Lyft and Uber, and workers at other new corporations should be able to receive compensation for their hard work in providing service or building a product. While, some key workers receive stock options with a strike price below the IPO price, we propose that all workers receive stock shares in a pool at the time of IPO, they can cash out or keep the stock then they receive a reward as well as founders (workers should not be forced to hold shares longer than management). Stock pool shares can be awarded based on service years, performance ratings or other recognition approach that is objective and fair to all workers. After all, isn’t it worth it to founders to build a workforce that is loyal and excited about the company, by letting go of even 10 % of their billion dollar stock reward or $100 million to workers?