(Editor Note: Insight Bytes focus on key economic issues and solutions for all of us, on Thursdays we spotlight in more depth Solutions to issues we have identified. Fridays we focus on how to build the Common Good. Please right click on images to see them larger in a separate tab. Click on the Index Topic Name at the beginning of each post to see more posts on that topic on PC or Laptop.)

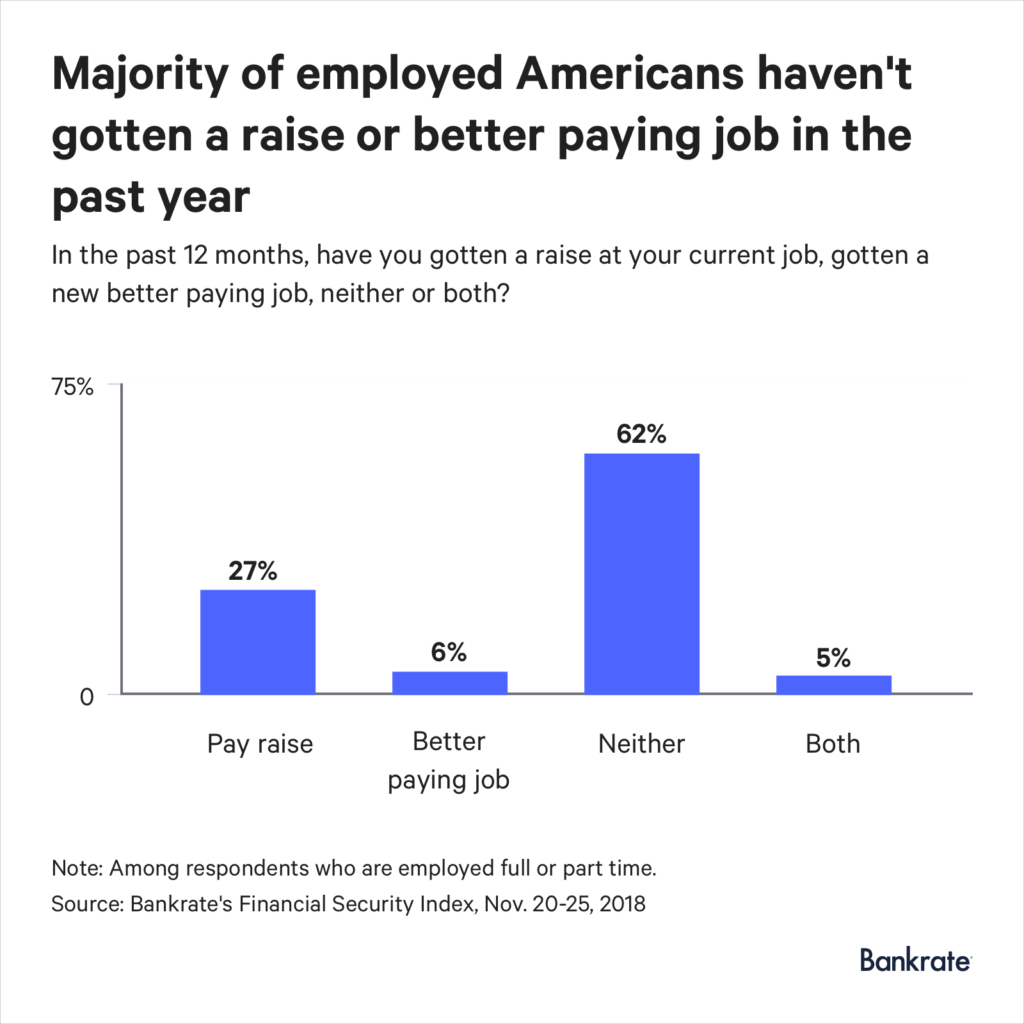

Last month, Bankrate.com completed a survey of 1,000 workers from all income levels across the U.S. and found that only 27 % of existing full time and part time workers had received wage increases. For all the recent news about wage inflation, from the worker perspective they just aren’t seeing the wage increases. The wage inflation reported by government surveys is an average and does not take into account income levels. The higher paid workers are getting the raises so the average moves up.

If a worker changed jobs then the pay raise figure rises by 5 %, though from our perspective that still seems low. When workers change jobs shouldn’t they be receiving a raise in this tight labor market? This trend seems to indicate that wage leverage for workers is still quite low compared to the power businesses have over wage increases. As we have noted in the past businesses enjoy leverage over workers by automating jobs, Internet access to hundreds of candidates nationwide and outsourcing of non-core functions. Plus, executive power is increasingly concentrated with mergers and acquisitions cutting down the number of competitors that workers can chose to work.

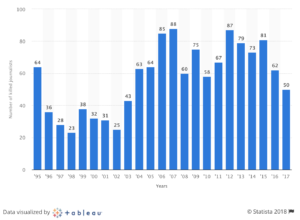

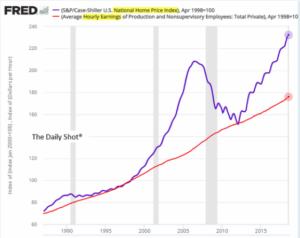

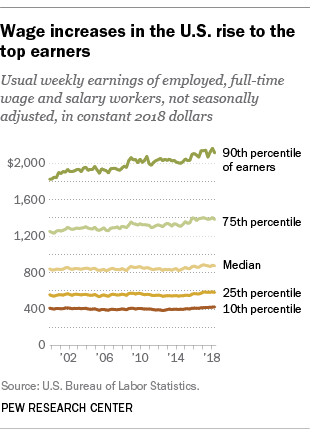

Pew Research reports most pay raises going to the top 10 %,while non-supervisory and production workers barely received any wage increases.

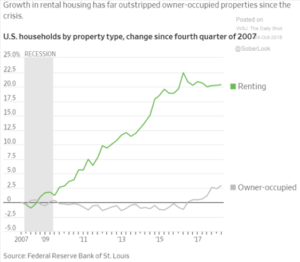

Real wages (taking into account inflation) have risen 4.3 % since 2000 for the lower quarter in income. Yet, for the top 10 % wages have increased by 15.7 % or $2,112 per year. Some of the pressure employers feel is from increased health insurance costs and adding non-wage benefits to keep pace with competitors. The reality is that wages are what workers have to use to make the majority of their payments for housing, food, and necessities. Plus, wages for the top 10 % keep going up anyway, so why don’t workers get the same rate of wage increases?

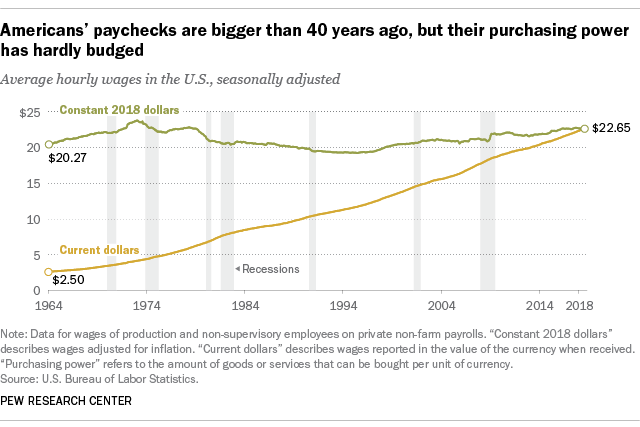

Wage stagnation has been happening for years. Since 1964 an analysis of wages for production and non – supervisory workers by Pew Research shows that today’s wages have just not kept up with inflation.

Next Steps:

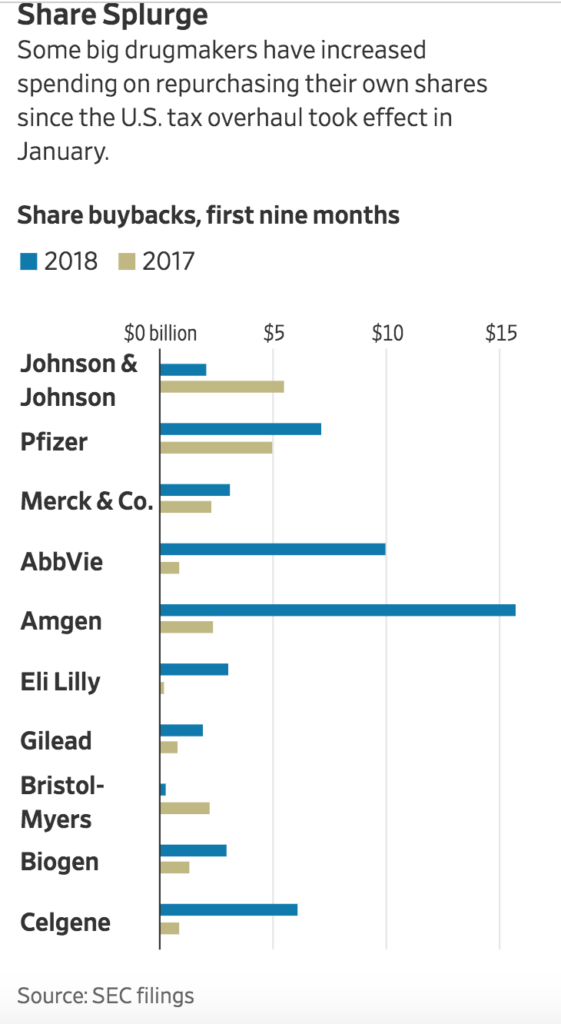

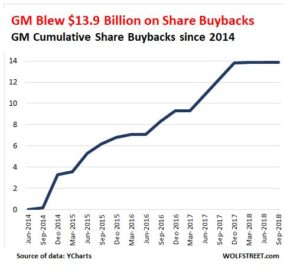

For all the discussion in the financial media about a wage inflation spiral the reality is that structurally workers in the lower 80 % income bracket are not getting their fair share of the economic pie. While, there have been federal laws proposed for limiting CEO pay Portland, Oregon has passed a law with a limit for executives at 150 % of worker pay or tax penalties are paid. Regulating pay in this way seems to be micro managing pay scales. However, we have a fundamental issue with pure capitalism of the American economy not delivering wealth to the vast majority of workers. In the 1970s, 1980s workers were receiving wage increases at 6 %, 7 % and sometimes 8 %. After the Great Recession workers are just averaging 2 % to 2.5 % in wage increases. Globalization caused outsourcing of manufacturing jobs held by the working class which hallowed out good paying lower education jobs. Millions of manufacturing job have been lost and not replaced. Our economy is 70 % services based with highly educated knowledge workers receiving most of the benefits. Ending stock buybacks would certainly put more cash into corporate coffers to distribute to workers – but will executives raise wages? Raising wages is an expense on the corporate ledger, and executives are paid to increase profits not reduce them. Executives are at the pinnacle of their power. Yet, as a society we have to fundamentally rethink how we make the economy work for all not just the few at the top of the corporate pyramid.