Photo: the74million.org

North Carolina teachers protest today asking for school funding increases to be used for school nurses and an increase in per student funding now just 39th nationally, following their colleagues in West Virginia. In West Virginia teachers were successful at achieving a 5 % raise. Other teachers in Kentucky, Oklahoma, Colorado and Arizona have gone on strike for raises or more school funding.

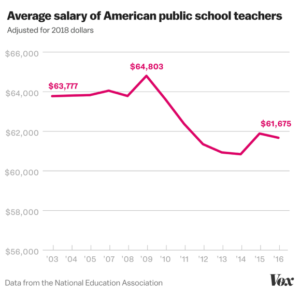

Sources: National Education Association, Vox – 3/18/18

Teachers have actually been losing income since the Great Recession when inflation is considered, it is little wonder that they are fed up with districts not paying them a fair wage to live at a middle class standard of living.

The Department of Education reports that 94 % of all teachers have to purchase their own supplies for their classrooms at an average of $479, adding insult to their lack of pay. Today, it is a 24 hour 7 day a week job, answering emails from students and parents, and responding to text messages at all hours. As education becomes more critical to get a good job, parents are even more demanding of their children’s instructors putting constant pressure on under resourced teachers.

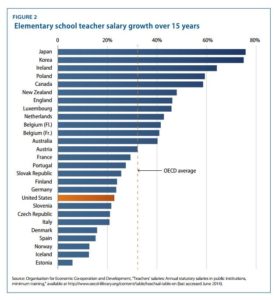

How do our teachers’ salaries and raises compare with other developed countries? Japan, Korea, Ireland, Poland, Canada are way ahead of us in offering raises of 75% to almost 60 % in providing raises for elementary teachers over the last 15 years versus the US at 25 %.

Sources: OECD, Education Week – 6/2014

If we want to provide the opportunities for our children to have good careers, in whatever field they choose we need to be making a much larger investment in our education system from kindergarten through college.

Next Steps:

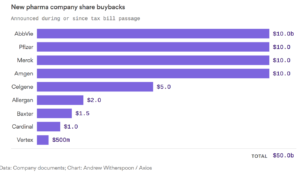

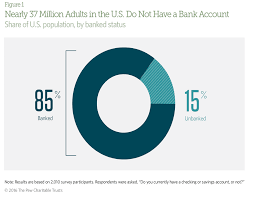

Robert Reich, former Secretary of Labor for President Clinton and Professor at UC Berkeley sees part of the salary issue in the source of funds for our schools. The school systems evolved from local cities and districts mostly funded by local property taxes. Wealthy districts in California spend about 3 times the funding or poorer districts. When school foundations are considered the disparity is even greater and rich parents receive a tax deduction as well. We see a need to provide funding primarily across states (which some states do supplement poorer districts) but equally across the country. In OECD countries they invest in their students equally with even more funding provided to poorer districts. In the US only 14 % of the funding for local district schools comes from the federal government. OECD governments provide 54 % of the funding for local districts. We need to get serious about the future of our children and provide consistent national funding for education. Increasing taxes on corporations who have the lowest tax rates since the 1980s would be a good place to start since they are sitting on $1 trillion in cash mostly in off shore accounts or using their profits to do stock buybacks compensating executives at 300 % of their average workers’ pay. Especially, in America’s Heartland our young people are not receiving the education they need to build careers, and businesses in their communities to make thriving regions after being hit with many businesses shutting down or moving overseas.