(Editor Note: Insight Bytes focus on key economic issues and solutions for all of us. Please right click on images to see them larger in a separate tab. Click on the Index Topic Name at the beginning of each post to see more posts on that topic on PC or Laptop.)

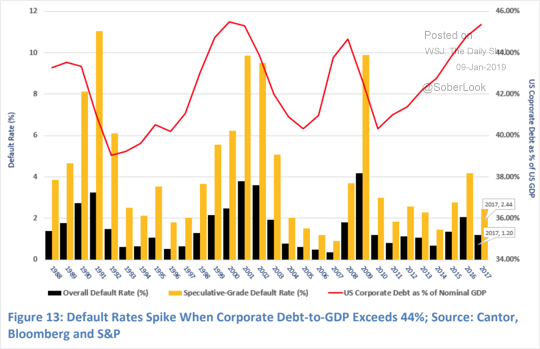

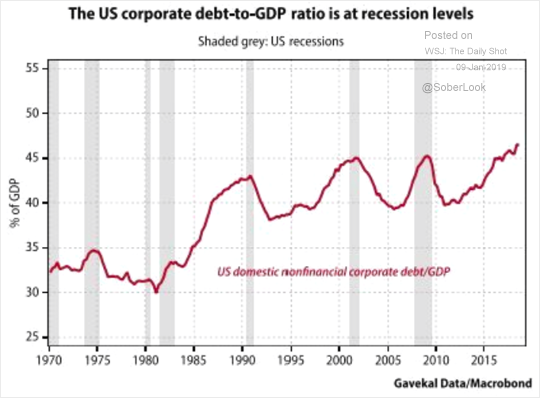

S & P 500 corporations have been borrowing money to buyback stock and increase dividends to investors. Increasing their debt bubble could increase the probability of defaults. Research shows that defaults spike when the corporate debt to GDP ratio exceeds 44 %.

When companies take on so much debt defaults become a real possibility when sales fall, or profits are squeezed as debt payments become due. Apple recently announced that iPhone sales were falling in China and has decided to cut production of all iPhones by 10 %. Apple has plenty of cash, but their suppliers may not. Fedex in December announced plans to offer domestic employees buyouts because ‘global trade has slowed in recent months and the company expects trade to slow further.’ We can expect more reduced earnings and sales guidance beginning next week when 4th quarter reports begin coming in.

When corporate debt to GDP ratios close in on 44 % or exceed that level recessions are likely to follow as the chart above shows. There is much discussion in the financial press about whether there will be a recession or not. It seems quite possible that record corporate debt combined with a likely fall off of sales in the 1st quarter of 2019 due to pull up buying by companies in the 4th quarter of 2018, will cause an economic slowdown or recession. The slowdown is made much worse by corporations overindulging in debt to finance stock buybacks and dividend distributions. Plus, turning around these companies will be more difficult as defaults spiral downward, more companies are forced to close or layoff workers. As workers are laid off they reduce spending, then reduced spending causes broad sectors of the economy to experience sales and profit declines.

Next Steps:

Where is the oversight of spendthrift management policies? Directors are likely on stock bonus plans too, so they enjoy seeing the stock price goosed by share buybacks. Where is a voice of moderation looking out for the long term viability of the company for customers, employees, shareholders and communities going to come from? We need a national dialog on how to improve corporate governance taking into account the needs of all parties represented to reign in profligate borrowing . Certainly, corporate executives did not start the trade war but they have borrowed way too much placing their firms in peril. It is management’s responsibility to look out for the interests of all effected by company success or failure.