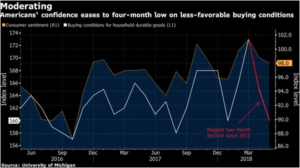

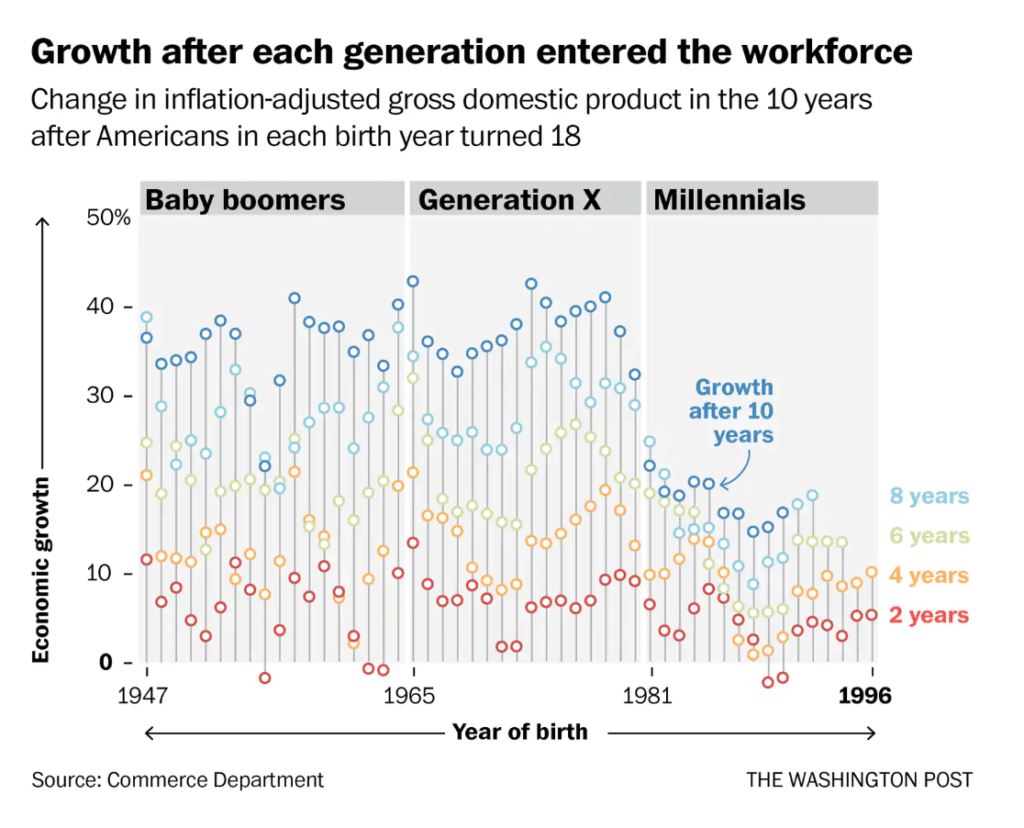

Millennials have seen the lowest level of GDP growth of three major generations since WWII. Baby Boomers, Gen X enjoyed GDP growth rates of between 30 – 40 % in the ten years after they turned 18 years old. While, Millennials experienced half those GDP growth rates .

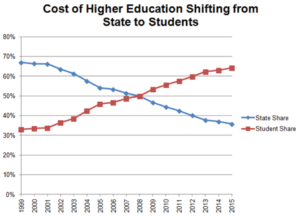

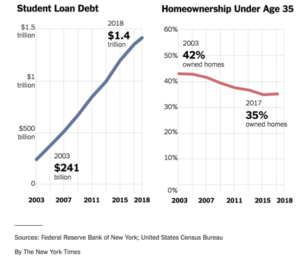

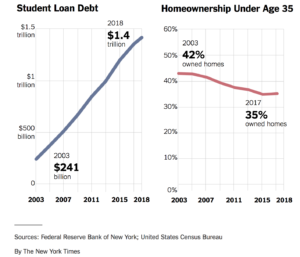

To gain entrance to good jobs, Millennials became the most educated cohort in America’s history – yet at a price. Student debt is at an all-time high of $1.5 trillion. This debt level has caused at least 400,000 potential young buyers of homes to be left out of the housing market in 2014, according to Federal Reserve economists. One reason students needed to take on such massive debt loads is states for the past 30 years have been drawing down their financial support of college education by between 60 – 50 %. Universities were left no choice to fill the funding gap except by raising tuition.

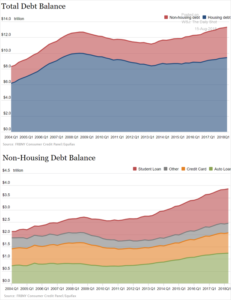

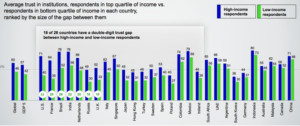

We have documented in previous posts that real wages for the 80 % in income group have been basically stagnant for the last 30 years. As the nation’s top 20 % gains 90 % of the income and wealth gains since the Great Recession, Millennials have been further challenged to keep up, particularly if they have no college education living in inner cities and Midwest rural regions. The hallowing out of manufacturing in the Midwest and South has produced low wage, low benefit, limited future jobs for young people. Add the slow Internet infrastructure and lower quality healthcare makes the future look dim. Is it any wonder that the Heartland has the highest opioid death rate in the country?

Millennials feel their lack of an economic future in other ways, delaying marriage by 8 to 10 years and having children 5 – 6 years later than other generations.

Next Steps:

A whole generation has been missing out on the benefits of the fastest growing wealth generation economy in the world. As income and wealth goes to the top 10 % to the highest level of concentrated wealth since 1929, the education services that make for a broad based pluralistic economy have fewer student slots and extremely high tuition. Corporate and wealthy individual taxes are at the lowest levels in 50 years. Our higher education system is turning into a grinder for people of modest means, carrying a heavy burden of debt for young people to begin their careers and families.

The number one issue for Millennials is student debt. We need as a country to deal with this problem. Students did not withdraw support for state colleges and universities, taxpayers and state governments did withdraw financial support with huge consequences for our young people and our economy. There have been a variety of proposals to reduce student debt including, forgiving debt completely, or forgiving debt for service to the country (as a proposal we made in a post to focus on investing in our Midwest communities), require corporations to provide more training for employees, and corporate support of a national apprenticeship program at a funding level and quality of Germany’s apprentice program for non – college careers.

The key is we need to end the bickering between conservatives, independents and liberals and take on the economic challenge of huge debt that our young people have today. Certainly, these people need to take responsibility for their own economic future, but we who created the present economy of winners and losers need to do better by our young people or when they gain positions of economic power we may not like the economic system they setup.