(Editor Note: Insight Bytes focus on key economic issues and solutions for all of us, on Thursdays we spotlight in more depth Solutions to issues we have identified. Fridays we focus on how to build the Common Good. Please right click on images to see them larger in a separate tab. Click on the Index Topic Name at the beginning of each post to see more posts on that topic on PC or Laptop.)

Photo: wikipedia.org

To: CEOs – S & P – 500

From: The Progressive Ensign

Subject: Stock Buybacks Are Out of Control

Date: November 5, 2018

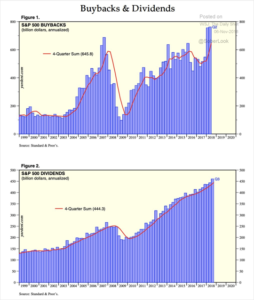

Congratulations, this past quarter you knocked earnings out of the park, profits were higher in particular, though revenues lower and you did well by raising stock prices to new highs in September via stock buybacks.

Source: Standard & Poors – 11/4/18

Ok, you did well on stock compensation too with soaring stock prices. You can take that trip to Cancun, buy a boat and a villa for extended stays. You have worked hard, your team has gone all out to make your companies successful, and worked harder. Remember, while you were traveling and making decisions on sales, financing, product development and marketing they are actually designing, building, shipping, selling and supporting your products and services.

Sources: The Labor Department, The Wall Street Journal, The Daily Shot – 11/5/18

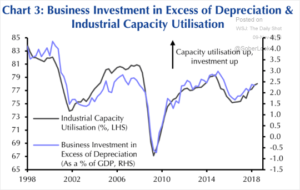

Next, you have not been making the investments in capital equipment , R & D and innovation to move companies along and be prepared for more overseas competition or increase productivity. Thanks for moving wages higher for less than high school educated workers recently they still aren’t enough to keep up with inflation though. If you can increase productivity we can give workers raises without it hitting the bottom line an increasing cost, and earning would be stabilized or even get better. You wouldn’t need to use financial gimmicks like stock buy backs to take stock off the market, and goose the price so earnings look better on a per share basis. Between 2010 and 2017 S & P companies spent 51 % of their operating earnings on stock buy backs. That’s money just hyping stock nothing else. Note that business investment is continuing to decline with lower highs and investments flat since 1998.

Sources: The Wall Street Journal, The Daily Shot – 11/5/18

Your joy ride on $1 trillion of stock buybacks needs to end. We want to see a plan by the end of the month on how you will use that $1 trillion dollars in meaningful long term ways such as raising wages, job training, purchasing new equipment and systems, and innovating new products. You are basically taking away the future of your workers and the country for your short term gain. Show by quarter how you will implement the plan and get your businesses actually growing again (in real dollars not financial gimmicks), workers supporting their families in sustainable lifestyle and making America stronger.

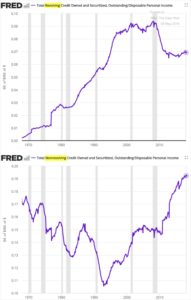

P.S. By the way, it is time to end your constant borrowing, rates are going up, and you spent most of the money on stock buybacks or other goodies not investing in the company. You are mortgaging the future of the business by taking on a record amount of debt. Please submit a plan for retiring this debt as part of your financial plan for investing in the company by the end of the month.

P.P.S. For those of you ( a minority) who are not doing stock buybacks, thank you, and you who are spending on capex and raising wages thanks a lot! Just submit a set of graphs showing your investments so we can show the other CEOs how it is done – as a best practice.