Photo: finder.com.au

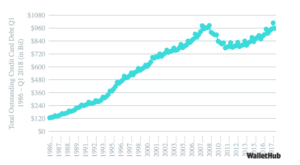

While consumers did pay down their credit card debt by $40 billion during the first quarter of 2018, they still owe a giant $1.021 trillion in revolving debt. Credit card debt is at the second highest level since 2008, during the Great Recession. Consumers piled on another $91.6 billion by the end of 2017, at a run rate of 104 % of the average over the past 10 years.

Sources: Marketwatch, WalletHub – 6/13/18

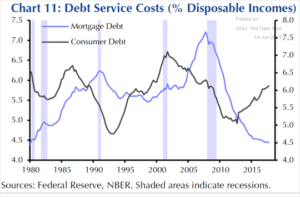

Adding to consumer woes are interest rates that are rising, adding to the servicing costs of credit card, auto loan, and student loan debts. Below the chart shows debt servicing costs as a percentage of disposable income, while mortgage debt servicing is declining consumer servicing costs are rising.

Sources: Federal Reserve, National Bureau of Economic Research, The Wall Street Journal, The Daily Shot – 6/13/18

Finally, non-supervisory worker’s wages are stuck at 2.5% and when inflation is taken into account are largely flat. As consumers continue to try and maintain their standard of living, they are taking on more revolving debt which is costing more for them to pay. This financial squeeze is sustainable as long as jobs are abundant as they seem to be now, but if the economy turns down and layoffs happen it will be hard times for workers. A survey published today in the Wall Street Journal blog – The Daily Shot showed executives plan layoffs as the first approach to deal with tightened financial conditions and slow sales.

Next Steps:

Workers need to receive a living wage that is not stagnant as wages have been for the past 10 years since the recession. Over 14 % of all workers have not received a raise in the last year versus 11% prior to the recession. Stock buy backs need to end and those funds invested in raising worker wages, increasing productivity and providing job training and development. Corporations stash over 40 % of their profits in overseas tax sheltered accounts – all those funds need to come back to the US with companies paying their fair share of taxes. Corporations are the beneficiaries of job training and education, and should pick up more responsibility in terms of taxes for apprenticeship programs on par with those in Germany to provide US workers with the advanced skills needed to obtain a good paying job and create a dual track besides college. Today, there are more job openings than candidates available to fill those jobs, we need to invest developing worker’s job skills to close the gap.