![]()

Photo: newsregistrysf.com

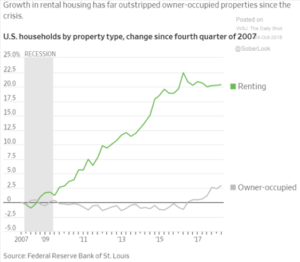

Since 2007 there has been a 20 % increase in the number renter households while the number of owner – occupied households has barely increased. Why? Right after the Great Recession home lending took a nosedive as foreclosure homes were worked off the inventory and lending standards were tightened. Builders focused on construction of multi-unit buildings where the market was more lucrative. Banks stepped back from mortgage lending, now the federal government backs about 70 % of all home loans.

Sources: The Federal Reserve Bank of St. Louis, The Wall Street Journal, The Daily Shot – 10/24/18

So, prospective home buyers saw few opportunities for them to buy homes, while wages for the 80 % in income were stagnant they had no choice but to rent. When the economy started to recover builders focused on high margin, luxury homes that were priced why out of the budget for first time buyers.

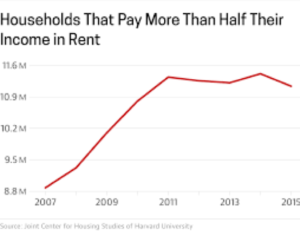

As cities focused on bringing more jobs into their business center building homes or apartments were a secondary priority because businesses provided more tax revenue. By 2011, there was a 37 % increase in the number of households paying more than 50 % of their income in rent. There were almost 11 million households paying more than 50 % of their income in rent, that is a staggering number of people who are financially squeezed.

Source: Joint Center for Housing Studies, Harvard University – 2016

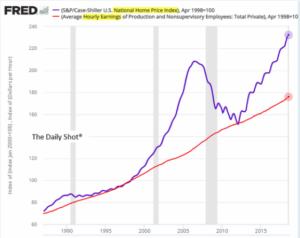

While the economy was taking off inflation increased much faster than the price of homes. Wages were not keeping up with the rate of home price increases which averaged about 6.7 % per year. The divergence between wages and home prices only continues to widen to the highest level since 2007.

Source: The Federal Reserve Bank of St. Louis – 2016

Between 2000 and 2018 the rate of inflation was 2.12 % versus 3.09 % so the greed factor for landlords was about 45 %. Why are rents moving up higher than the rate of inflation? Lack of affordable alternatives is one reason. In places like the San Francisco Bay Area and many metro areas, there is a huge jobs versus housing imbalance. In cities like Palo Alto there is a 20 to 1 jobs to household imbalance. With little competition in under housed growing metro areas landlords can charge any price they want. There just is not enough competition to keep an apartment building owner from raising rents.

Lack of homes means renters don’t have an alternate. Landlords have control because there are no other cheaper units nearby and the buying a home alternative is not an alternative for most working class folks with the home affordability index at its worst level in 8 years.

This lack of competition economists don’t seem to understand when rent price controls are proposed. When there is little competition apartment owners can just keep raising rents because there is nothing stopping them from gouging the renter.

Next Steps:

Most rent initiatives usually require a cap on rents as a way to deal with the problem. The problem with this approach is it penalizes the efficient property managers with the inefficient and greedy ones. We suggest a more innovative approach to tax the behavior we don’t want and give incentives for the behavior we do want. So if a landlord raises the rent above the normal cost of housing index by more than 1 % for a county then property taxes on the amount over would increase by 2x. This takes away the benefit raising the rent too high, the money won’t go to the landlord it goes to the city. If the apartment owner keeps the rent below the cost of living index by 2 %, they would receive a lower property tax by 4 % for that year, the money goes right to his pocket for running an efficient multi-unit business. In terms of building new units, these models can be used to come up with reasonable profits to attract investors while placing the focus on high quality property management.

Purchasing a home is crucial to providing competition to landlords. We have proposed in the past that the federal government provide incentives for builders to build less expensive homes with smaller square footage for the working class. Cities need to set aside land for homes, not businesses and quit being so greedy about the tax revenue they would get from a potential business taking the land. We need our leaders to make it a national priority for all families that want to own a home to be able to purchase a home on working class wages. When people own homes, they improve the home and the yard, the neighborhoods look better and values go up. People care more about their neighborhoods, schools and local services than when they rent an are likely to move somewhere else if the rent goes up.