Image: 15146affordablehousing.weebly.com

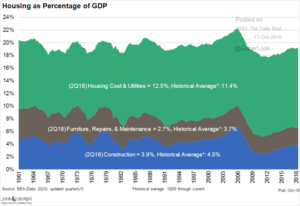

As a percentage of GDP housing has not recovered from 2008. Particularly, in two key categories: (1) Furniture, Repairs & Maintenance and (2) Construction. Additionally we know that appliance sales have been lagging as well due to tariffs and price versus worker wages being stagnant.

Sources: BEA, John Burns Real Estate, The Wall Street Journal, The Daily Shot – 10/18/18

Housing has not recovered from the Great Recession downturn from sub-prime mortgages and loose lending practices. As part of the recovery, banks were made whole with billions of TARP funds, but homeowners who tried to write down their principal loss on their homes to reduce mortgage payments were not allowed in court. Banks paid a small pittance of $50 million in homeowner relief that was distributed in a hazard manner. Millions of homeowners lost their homes and more importantly lost their equity. They could not replace their homes when the economy turned around, they had to take ‘make do’ jobs when they did finally find a job and are now left with little wealth to retire on except for Social Security.

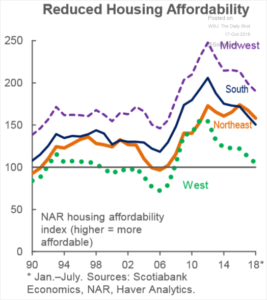

Young prospective home buyers face a daunting affordability crisis as the inventory of affordable homes is low as builders focus on wealthy buyers, who buy high margin homes.

Sources: Scotiabank Economics, NAR, Haver Analytics, The Wall Street Journal, The Daily Shot – 10/17/18

In all regions of the country affordability continues to fall after reaching a peak in 2012. Mortgage rates are at the highest level since the Great Recession, the inventory of middle class housing continues to decline and the commitment to homeownership is waning. We hear more and more about how ‘renting is really ok’ – for who? The wealthy landlords who continue to raise rents while raking in the cash. What about families who want yards for their kids to play in, or to gain ‘sweat equity’ by upgrading the home they live in or landscaping the yard. It is clear just looking at most neighborhood which homes are owned and maintained and which ones are rentals owned by an off premise landlord.

Next Steps:

Dropping the national commitment to home ownership is not the solution to the problem. We need to ensure that the 80 % who do the heavy lifting in the economy can afford to buy a home on their incomes. Corporations need to be increasing wages for workers at least as fast as their executives and more to ‘catch up’ to the raises and stock plans of the executive team receiving high compensation from stock and stock buybacks.

Reducing student debt, now at $1.5 trillion is critical so that prospective home buyers do not have student debt right at time they are starting families and purchasing a home. We have proposed a far reaching program building on existing student debt forgiveness programs to more comprehensive service for debt forgiveness programs.

Builders need incentives to build lower margin homes middle class homes in new developments. Local and state governments need to take on the charter of ensuring that affordable housing is a priority for zoning near commercial and business centers.

Fannie Mae and Freddie Mac need to be committed to focusing on first time buyers and lower income prospective buyers innovating ways to get them into homes while at the same time being financially responsible. The Federal government needs to provide more funding for the two housing agencies to bring down rates to an affordable level. Working in cooperation with groups like Operation Hope, banks need to make a new effort to make mid and lower income buyers financially literate and help them move into homes. Think what a huge difference it would make for our cities and rural communities if people owned their homes and made improvements to their home and yards.