(Editor Note: Insight Bytes focus on key economic issues and solutions for all of us, on Thursdays we spotlight in more depth Solutions to issues we have identified. Fridays we focus on how to build the Common Good. Please right click on images to see them larger in a separate tab. Click on the Index Topic Name at the beginning of each post to see more posts on that topic on PC or Laptop.)

Photo: wikipedia.org

Today, employees don’t share in the profits or success financially the way they did the past. Forty years ago, Sears offered their sales staff commissions, bonuses and retirement plans enough for many of them to retire on $1 million in today’s equivalent dollars. Amazon recently announced raising all workers to $15 @hr, yet they are eliminating stock and bonus plans. Hourly staff will be left with little for retirement except what little they can save.

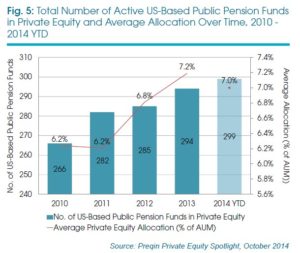

What is driving management to not share company financial success with employees, or increase investments in productivity which would support a raise in wages? One factor is Wall Street expectations of corporate management to keep the cash machine cranking full speed.

Sources: The Daily Shot, The Wall Street Journal – 10/25/18

Companies that invested in capital equipment to increase productivity or R & D to innovate were penalized by Wall Street investors driving their stock price down. Note that on the lower chart the relative performance of investment focused on capex companies versus cash return in buybacks and dividends is 6 % less and has been falling since a year ago. Executives quite often receive as much as 80 % of their compensation in stock options based on stock performance and earnings targets. Spending money on expenses by increasing wages, capital equipment purchases or innovative research reduces profits and does not provide more funding for stock purchases to drive the stock price up.

Next Steps:

Our post this past Labor Day notes how Wall Street wields power over the economy, and drives executive decisions on allocation of resources.

“Wall Street, the citadel of capital, wields supreme power focused on profit throughout our economy and control of our government. Corporations pander to financial leaders with ever higher profits manipulated by stock buybacks juicing the value of share prices. Management ensures investors are pleased with financial results using loose financial gimmicks and laying on record debt. While workers have seen their wages stagnate for 30 years since the 1980s.”

Yet, Wall Street is beginning to change with major leaders beginning to recognize the need to invest in corporations that take social responsibility and worker value as core principles.

“We need to require corporations to report on how they are building employees as assets and worker contribution to increasing company value. The next step is for Wall Street to recognize social responsibility in their investments as Blackrock, CEO Larry Fink, has in a letter to CEOs of companies in their portfolio that he will be looking beyond profit, for implementation of policies by management in sustainability and worker advancement.”

Harry Truman had the right perspective:

“Our most productive asset is our labor force.”