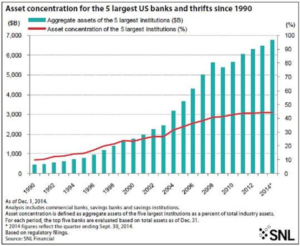

In 1990 the five largest commercial banks held just 10 % of all bank assets. Today the five largest banks control nearly 50 % of all $15.3 trillion in bank assets! These five banks virtually are our banking system: JP Morgan Chase, Bank of America, Wells Fargo, Citicorp and US Bancorp, with Wells Fargo holding the same level of assets by itself that the top 5 banks held in 1990.

Source: SNL Financial, Forbes – 12/3/14

Experts like Neil Kashkari who led the Bush Administration’s $700 billion bank bailout effort the Troubled Asset Relief Program, thinks these mega banks should be broken up. Now Kashkari is the Federal Reserve Governor for Minneapolis and has called for reducing the size of the big banks and distributing their power and control to provide a better shock absorber in the event of another banking crisis. He even calls for a 25 % capital reserve requirement many times the present capital reserve requirements the Federal Reserve has maintained in its stress test program. We have seen with the failure of Wells to protect its customers from 3.5 million fake checking accounts created by its sales staff how poorly bank management performs. Now, the bank is being investigated for improper referrals and transferring of funds in the wealth management division.

Enough is enough, our present financial system is too concentrated to effectively manage; distributing wealth, power and control back into regions is one way to ensure reasonable oversight and management can prevail. In addition, we support calls for a modern day Glass-Steagall Act to separate investment banking (were sub–prime derivatives of the Great Recession were created) and commercial banking for retail customers. We need to protect our citizens financial assets from the financial engineering and schemes of Wall Street. It is not a coincidence that today 90 % of all wealth is held by the fewest number of people since 1929. We know what happened after 1929 – we don’t need a repeat of the Great Depression.