(Editor Note: The following blog is the result of a completed in depth research project into multi-dimensional problems facing our Heartland and we developed an innovative renewing sustainable solution. References are in the Research tab under this blog name, please right click on the charts to see them larger in a separate browser tab.)

The View:

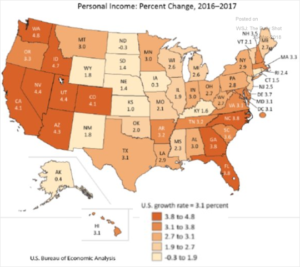

Rural and inland regions in the Heartland have been left out of the robust growth centered mainly in coastal regions. The Heartland of America has been falling behind in education, entrepreneurship, health, housing, mobility, and digital infrastructure for the past 20 years. The rebuilding of these key regions is a multi-dimensional problem requiring a major investment similar in scale to the Marshall Plan after WWII. Yet with a different funding approach – building a startup non-government organization. We are recommending a difference approach by the Federal government to act as an investor in a non-government organization called a Heartland Development Center. An HDC acts as a central hub of critical services and infrastructure development while providing a continuous innovation system. The Heartland Development Center acts as a catalyst creating an innovation ecosystem to jumpstart local economics and social structures. HDCs would focus on all the key issues that a region needs to address to rebuild their economy and people’s lives: business formation, education and training, digital infrastructure, affordable housing, engaged local innovation media and health care. The Federal government would seed the financing of these NGOs in key regions with additional funding from local and state governments, and major corporations who would benefit from the newly available job force tuned to their needs. HDCs would be ‘startup’ organizations bringing in leaders in their respective fields – ie. business formation – Y Incubator, preventive health – Cleveland Clinic, or training – Opportunity@Work as contractors to the HDC. These NGOs would establish continuously renewing innovation processes to stay in touch with their citizen – customers and businesses. Administration services would all be contracted using cloud software services for HR, Payroll, Training, Benefits and other internal systems to keep costs down. The HDC startups would be piloted in 3 non metro areas, where they would tune their business and socio economic models for maximum impact, then use those working models to implement HDCs in 25 or more other key regions for 5 – 10 years.

The Story:

The Heartland of America been spiraling downward in terms of education, entrepreneurship, health, housing, mobility, digital infrastructure and jobs for over 20 years. All of these factors combine to create sub-nation apart from coastal and metro prosperity. Jobs programs in rural areas will not be enough to bring these regions to a tipping point in socio-economic growth. Other factors create huge challenges: the opioid epidemic has hard hit heartland communities where for example. some Ohio machine shop employers find 50 % of their job applicants for machinist jobs test positive for drugs. The Heartland is where: (1) mobility to take new jobs is the lowest in rural and small cities in the Midwest and South (2) there is the highest concentration of young people without a 4-year degree (3) the lowest concentration of entrepreneurs is holding back business formation and development to create new higher paying jobs with a future (4) the largest number of people without health insurance are found in the South and rural areas of the Southwest and West (5) slow speed Internet connections are the norm leaving many heartland regions way behind in the digital revolution where new jobs, opportunities for education and quality health are being developed and accessed (6) accounting for births, deaths and migration rural population has declined for five consecutive years. It is deplorable that a complete socio-economic region of the country has so many factors that have not been addressed to extent necessary to transform people’s lives toward good health and fair share of prosperity.

Rural and small town America enjoyed a renaissance of increasing jobs and prosperity into the mid 1990s. During this time rural counties were home to more than one-third of all net new businesses establishments fueling the job creation engine. Yet, in the past ten years the economic conditions have changed dramatically, leaving these regions out of robust growth in coastal areas since the Great Recession.

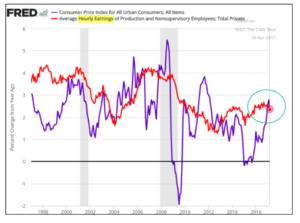

Employment

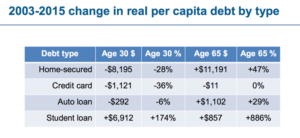

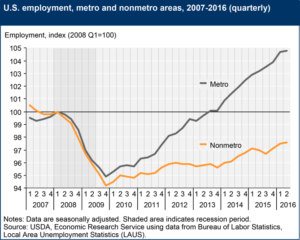

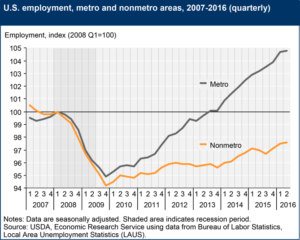

Rural or Non Metro areas have not regained the same level of employment as pre-2008 recession levels:

Sources: USDA – Economic Research Service, Bureau of Labor Statistics – 12/2016

Non Metro areas lost more jobs as a percentage of the labor force than Metro areas did during the recession and has not caught up. Non Metro employment was estimated to be 20.684M jobs in the 1st quarter of 2007 versus the 2nd quarter of 2016 with 20.091M jobs a 2.9% reduction or a loss of almost 600k jobs. While Metro areas during the same period exceeded recession employment levels by 4.8%. At least 50 % of the Non Metro deficit relative to Metro areas was due to zero population growth between 2010 and 2013. This factor was partially offset by an increase in hiring in the oil and gas industry when gas prices were high and fracking exploration was exploding in Midwest oil fields.

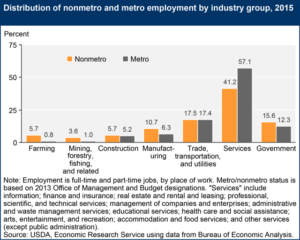

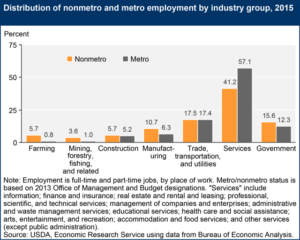

The distribution of industry sectors hurt Non Metro employment as the number of manufacturing jobs fell 20 % from 2001 to 2015. Non Metro areas were severely impacted as they had nearly twice the number of manufacturing jobs as a percentage of total employment versus Metro areas.

Sources: USDA – Economic Research Service, Bureau of Economic Analysis – 2016

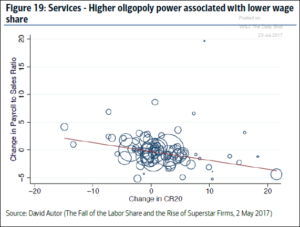

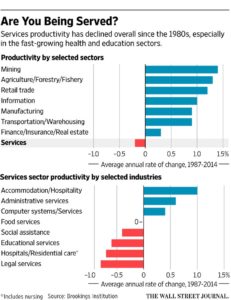

Non Metro areas exceed Metro employment in sectors like Farming and Mining, Forestry and Fishing, Construction is about even with Trade, Transportation and Utilities is comparable. Yet, in Services, the fastest growing sector of the economy, Metro areas have a 16 % employment advantage over Non Metro areas.

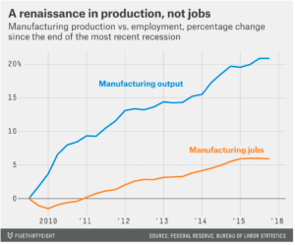

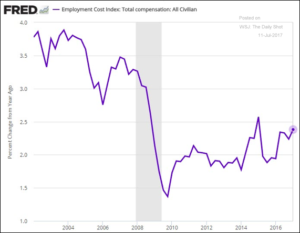

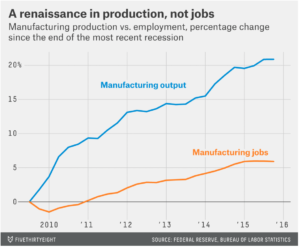

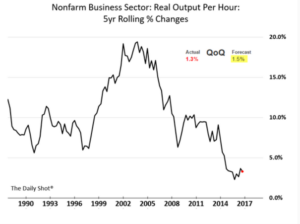

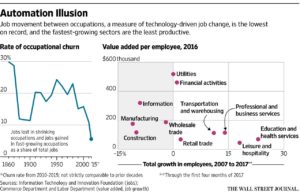

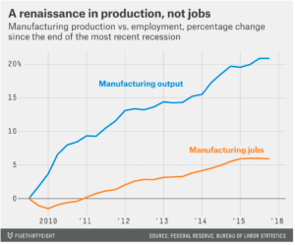

Manufacturing companies concentrated in rural counties and near metro areas have increased employment by about 5 % in the last 6 years. However, due to automation far fewer workers are needed to increase output up to 20 %:

Sources: FiveThirtyEight, The Federal Reserve, Bureau of Labor Statistics – 3/2016

The ability of companies to dramatically increase output with fewer workers translates into fewer job opportunities for factory workers many without college degrees needed for knowledge management based work.

Other factors need to be addressed – like ensuring that workers even when trained are not in such despair that they are taking drugs. Or when on the job, their illnesses can be dealt with quickly and return to work immediately.

Health

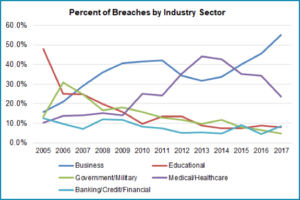

Rural health providers face a daunting set of challenges in providing healthcare to a declining population, with high unemployment rates, reduced insurance coverage and limited access to broadband Internet for treatment information and patient records.

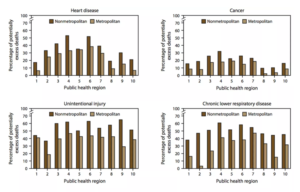

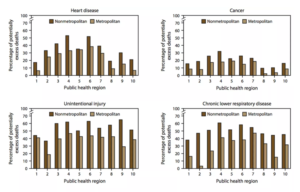

Excess deaths in heart disease, cancer, non-intentional injury and chronic lower respiratory disease are higher in Non Metro areas:

Source: CDC – 2015

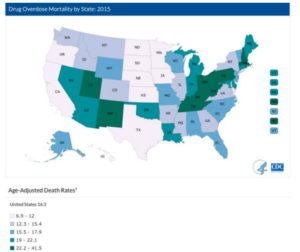

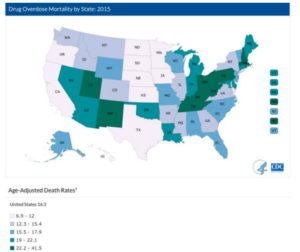

In heartland states drug overdoses are at epidemic levels:

Source: CDC – 2016

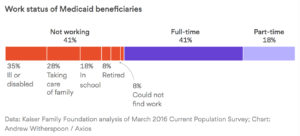

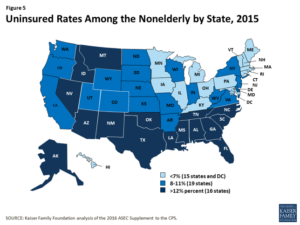

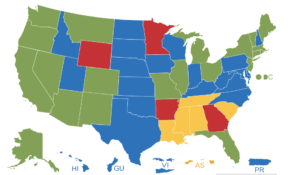

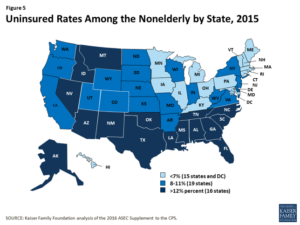

Unfortunately, many Non Metro regions have limited or no insurance coverage, some have decided not to accept Medicaid help from the federal government – ie Texas. These no-coverage policies for many of the working class and poor mean that their health care is drastically reduced as shown in the charts above.

Sources: The Kaiser Family Foundation – 2016

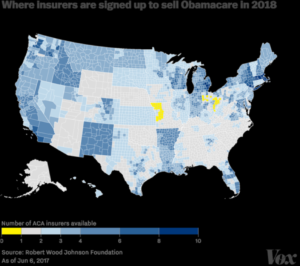

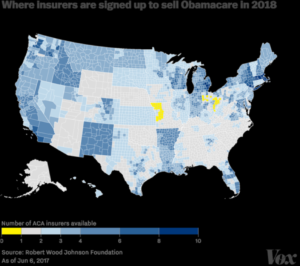

The Affordable Care Act or Obamacare helped to reduce the total number of uninsured people from about 14 % total to about 9.2 %. However, as noted in the chart below for insurance plans under the ACA for 2018 many areas in the South and Southwest, and rural western states have only one insurer or some have none.

Source: Robert Wood Johnson Foundation – 6/6/2017

One major issue for health care providers and business leaders interested in bringing in new businesses is high speed Internet access and the lack of a digital infrastructure.

Internet

University of Texas researchers found in a study of rural communications in Oklahoma, Texas and Mississippi that rural household incomes went up and unemployment rates dropped in rural counties where broad band internet was installed.

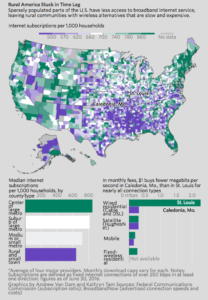

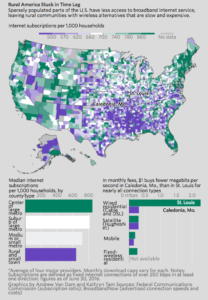

The number of rural households connected to the Internet is directly proportional to Internet speed. As this graph shows Internet subscriptions per 1000 households by county where metro areas like St. Louis dense household connectivity vs a rural town like Caledonia, MO.

Sources: FCC, Broadband Now, The Wall Street Journal – 6/15/17

The FCC defines fast speed Internet as 25 Mbps about 39 % rural households in the US or 23 million people lack access to broadband Internet service. Only 4 % of of urban – metro households do not have high speed access.

A major challenge is that a city like St. Louis has 5,000 people per square mile compared to rural counties like Washington where Caledonia is located with 33 per square mile. Installation of fiber optic trunk lines cost about $30,000 per mile including access rights – so population density is crucial to meet financial targets for providers.

Broadband Internet access is like electricity was in the past – in 1935 only 10 % of rural America had electricity. President Franklin D. Roosevelt drove an initiative to connect every rural household to electric power and two decades later 90 % of all rural households have electricity.

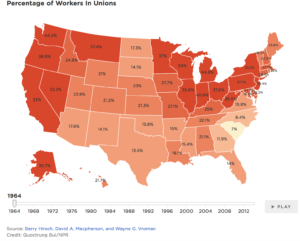

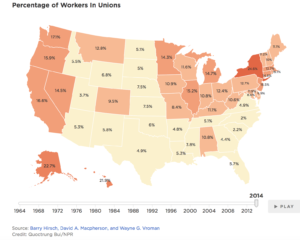

Entrepreneurship

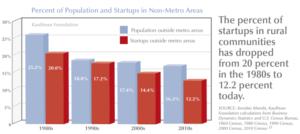

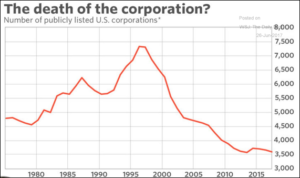

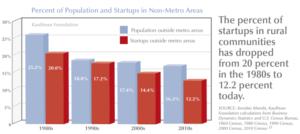

Rural communities once thrived in starting new businesses, however today the percentage of startups in rural areas has dropped from 20 % in the 1980s to 12.2 % in the 2010s.

Source: The Kaufmann Foundation – 2016

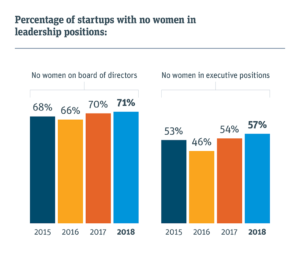

There are gaps between the largely white young entrepreneur often thought of in starting a Silicon Valley startup compared to a minority entrepreneur. Experts estimate that if minorities started and owned businesses at the same rate as whites that there would be over 1 million more new businesses creating an extra 9.5 million jobs.

Education impacts the propensity of young people to start businesses. Rural areas have a lower percentage of college graduates than metro areas. Adults without a college degree make up 11.6 % of the population but only 3.4 % of entrepreneurs.

Mobility

Americans have been always willing to move to ‘greener pastures’ for a new career or business opportunity, as evidenced in the Dust Bowl days of the 1930s and the migration to California, or the movement of southern African-Americans to northern states like Michigan for jobs in auto manufacturing after WWII.

Yet today that attitude and confidence is fast draining away, into a sense of not ‘fitting in’ for rural community members moving to a metro area or even small cities surrounding metro areas.

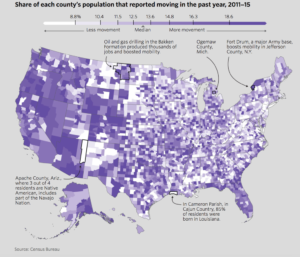

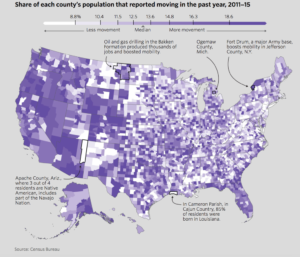

Mobility is at its lowest level on record since records were first kept after WWII, dropping by 50 % since a peak in 1985. After WWII about 20 % of Americans reported moving in the last year, that figure has now fallen to 12 %, a 40 % decline.

Source: Census Bureau, The Wall Street Journal – 8/2/17

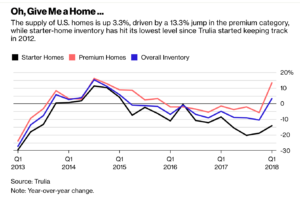

There are three aspects related to reluctance to move: culture, housing, and education. On a cultural basis in many rural regions people are devout in their religion who don’t feel when they talk with ‘coastal people’ they are not appreciated, understood and end up being ridiculed for their values. In housing, over the last 8 years since the recession in metro areas restrictive zoning laws have reduced the availability of housing driving prices way up. Yet in rural areas housing prices are just now getting even with pre-recession levels. For a school custodian in a rural area, without a college degree a job in a metro area may pay 50 % more but housing could be 3 or 4 times more expensive. For those with college degrees, in a profession like an attorney can move from a rural area and handle the increase in housing costs due to a much higher salary ratio to housing costs, based on recent research. Finally, lack of education prevents young adults from taking jobs in higher paying metro areas where the knowledge economy requires a 4-year degree and in many cases an advanced degree.

Another issue is the possible ‘brain drain’ of losing young people to larger cities and where they stay. The small town loses the talents and innovation of its bright ambitious younger people. Investments in Non Metro areas need to offer both incentives for movement across county lines but opportunities that are created locally to build the local economy.

Education

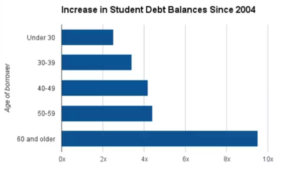

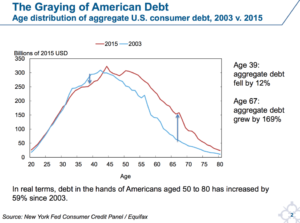

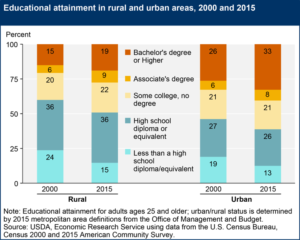

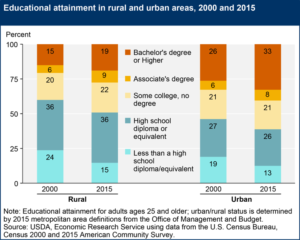

Rural areas have endured lower education rates than urban areas. For example, rural areas achieved a higher rate of bachelor’s degrees from 2000 to 2015 but they still are 73 % lower than the bachelor’s degree rates of urban areas. Rural residents often have to travel further for college studies and of those schools serving these areas they have experienced continuous cutbacks due to regional economic downturns.

Sources: USDA, Census Bureau – 2016

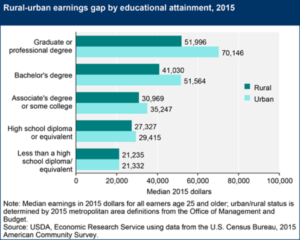

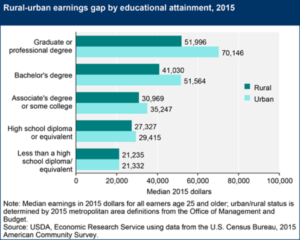

There is a direct relationship between education attainment and earnings – yet here again rural residents are earning much less than urban residents by 25 % for bachelor’s degrees.

Sources USDA – Economic Research Service, Census Bureau – 2016

While rural job holders with 4 year degrees experienced higher demand for their skills they were still behind urban residents – largely due to lack of local employment prospects.

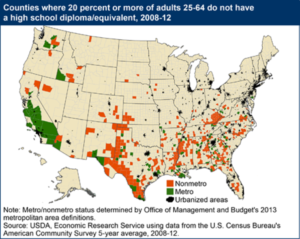

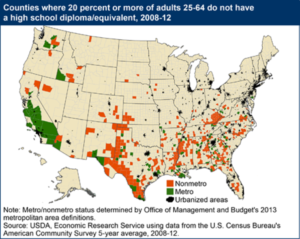

While there is a high rate of poor attainment of high school diplomas in inner cities, the problem is larger in rural areas. Of adults without a high school diploma 4 out of 5 are in located in rural areas.

Sources: USDA – Economic Research Service, Census Bureau – 2014

Rural areas hardest hit by unemployment are also those with the highest percentage of non-high school graduates in the South, East Central mountains and along the Mexican border.

The Solution:

The Rural Socio – Economic Crisis – Calls for Major Investment Now!

There is a major reason for the civil conflict we see today across America – it is the hallowing out of America’s heartland. Rural areas have been hardest by globalization, automation, fewer new business formations, lack of education opportunities, poor digital infrastructure, inadequate or non-existent health services and economic loss since the Great Recession leading to limited mobility to obtain better jobs or education.

A dedicated non-government organization (NGO) for centralizing multi-dimensional development in the heartland needs to be created, a Heartland Development Center (HDC). An HDC acts as a central hub of critical services and infrastructure development while providing a continuous innovation system. The Heartland Development Center acts as a catalyst creating an innovation ecosystem to jumpstart local economics and social structures. HDCs would focus on all the key issues that a region needs to address to rebuild their economy and people’s lives: business formation, education and training, digital infrastructure, affordable housing, engaged local innovation media and health care. The federal government would provide ‘seed’ funding with major funding from state, local and city government and major corporations who would benefit from the new available job force. HDCs would be ‘startup’ organizations bringing in leaders in their respective fields – ie. business formation – Y Incubator, or preventive health – Cleveland Clinic as contractors to the HDC. Administration services would all be contracted using cloud software services for HR, Payroll, Training, Benefits and other internal systems to keep costs down.

Training and Employment

To plug the skills gap in rural areas initiatives like the Opportunity@Work program are one solution. The training group started in the Obama White House focuses on providing Internet economy job training to workers in the heartland to gain digital skills for jobs in fields like programming and information technology.

Designing, developing and deploying focused apprenticeship programs for the Heartland is crucial to building a robust regional economy. Colorado has invested in its CareerWise to bring businesses, colleges and vocational training groups into partnerships providing all Colorado high school juniors and seniors with a dual career path leading to a community college associates degree plus key skills. Students can begin working on the factory floor as juniors learning key company job skills, and are guaranteed full time employment at the end of their apprenticeship along with financial support to earn a community college degree. This type of program provides a good template on how to implement a Heartland program.

However, an HDC goal to create over 1 million jobs in rural communities within 5 years will require significant investments by major corporations, foundations, Federal, State and Local government and universities to turn the present situation around.

In manufacturing, partnering with the ARM Institute (Advanced Robotics in Manufacturing Institute) is an alternative where ARM focuses on developing robotic solutions with partner companies and developing worker skills in robotics. Automation is growing fast in manufacturing, so US workers need to learn robotics management, support, and collaborative work to be competitive in the world manufacturing marketplace.

Major high technology companies like Apple, Amazon, Facebook have business development departments planning today where they will be locating manufacturing sites, customer support centers and other services. HDC leaders need to be developing relationships with fast growing companies to understand their business needs and ensure they are developing the local economies, infrastructure and workforce these companies need.

Entrepreneurship

The majority of new jobs come from new businesses, yet new business formations in Non – Metro areas are half of the rate in Metro areas. Contracting with experts like the Y-Incubator in Mountain View, who has invested in over 1450 companies with a combined market capitalization of over $80b capitalization. They provide programs for non-profits and profit making organizations and a network of consultants on business fundamentals in legal, logistics, manufacturing, services, finance, and marketing to help startups.

The Kaufmann Foundation provides resources for entrepreneurs to learn business formation skills and development. They setup entrepreneur and investor networks and complete research on the needs of entrepreneurs and the status of entrepreneurship in the US.

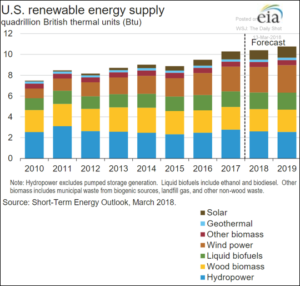

Digital Infrastructure

Similar to the Rural Electrification project of the 1930s, the heartland needs to have its digital infrastructure upgraded to full broadband Internet service of at least 25 Mbps and ideally up to 100 Mbps to all households. Google has been setting up mega bandwidth sites in areas like Utah and the SF Bay Area, possibly a program could be setup with them to target rural communities across the country. In Rural Electrification, the federal government lent funds to local cooperatives of local merchants or farms could be setup as an alternative in areas where local telecom cooperatives have already been established. A possible successful model is in central Missouri, where The Co-Mo Electric Cooperative, Inc. installed a fiber optic network to over 25,000 subscribers. The service has reached out to another 15,000 subscribers who are non-members in neighboring communities. Co-Mo funded their program with a $100 from each member upfront with 100 Mbps service costing $49.95 per subscriber per month. The FCC needs to ensure that all providers not just phone companies can participate and offer Internet access.

Healthcare

Rural regions have some of the highest rates of drug overdose, obesity and cancer and other diseases in the country. To support the economic development and job training programs to lift the region, healthcare services need to be upgraded and offered at reasonable rates to people. The Cleveland Clinic has a start-of-the-art illness prevention and wellness program they have implemented for their own employees that has saved them tens of millions of dollars per year. Contracting with leaders like the Cleveland Clinic to setup innovative health services programs partnering with local providers would be a way to jumpstart the upgrade process for health services in these regions.

Local Feedback, Communication to HDCs

One aspect of a major development program like the Heartland Development Center project is to keep renewing itself and gain continuous feedback on how effective its programs are with its clients – the people in the region. A non-profit, Spaceship Media, in cooperation with the Bay Area News Group and other media groups has deployed on the Internet ‘conversation experiences’ with local people over Facebook and other social media to connect people with each other to discuss issues and possible solutions. Similar groups can be implemented by HDCs as focus groups to ensure they are receiving continuous feedback to tune their programs or make major changes as needed. Teamed up with incubators, local business groups and universities a continuous innovation process can be implemented to constantly support HDCs to reinvent themselves and stay on track in meeting the needs of local people.