A recession is emerging with interest rate curves inverted, the end of the business cycle at hand, world trade falling and consumers and businesses beginning to pull back spending. The question is: will monetary or fiscal stimulus turn around a recession? In this post, we find both stimulus alternatives likely to be too weak to have the necessary economic impact to lift the economy out of a recession and will not help the middle class out of a stagnant financial position. Finally, we identify a new approach to government intervention based on an innovative ‘seed’ and multi-partner program to lift the middle class out of economic decline.

Our economy is at the nexus of several major economic trends formed over decades that are limiting monetary and fiscal options. The monetary policy of central banks has caused world economies to be immersed in liquidity yet resulting in limited growth. Central bankers in Japan and Europe have been trying to revive growth with $17 trillion injections using negative interest rates. Japan can barely keep its economy growing with an estimate of GDP at .5 % thru 2019. The Japanese central bank, holds 200 % of GDP in government debt. The European Central Bank holds, 85 % of GDP in debt and uses negative interest rates as well. Germany is in a manufacturing recession with the most recent PMI in manufacturing activity at 47.3 and other European economies contracting toward near zero GDP growth.

Lance Roberts notes that world economy is not running on a solid economic foundation if there is $17 trillion in negative yielding debt in his blog, Powell Fails, Trump Rails, The Failure of Negative Rates . He questions the ability of negative interest policies to stabilize world economies,

“You don’t have $17 Trillion in negative-yielding sovereign debt if there is economic and fiscal stability.”

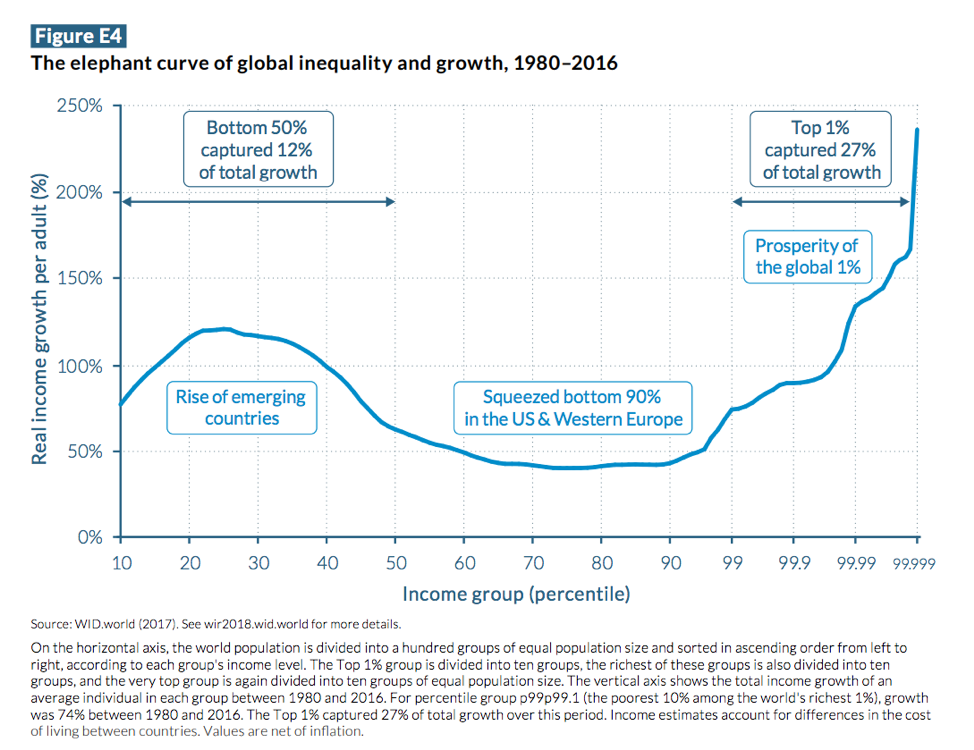

Negative interest rates and extreme monetary stimulus policies have distorted financial relationships between debt and risk assets. This financial distortion has created a significantly wider gap between the 90 % and the top 1 % in wealth.

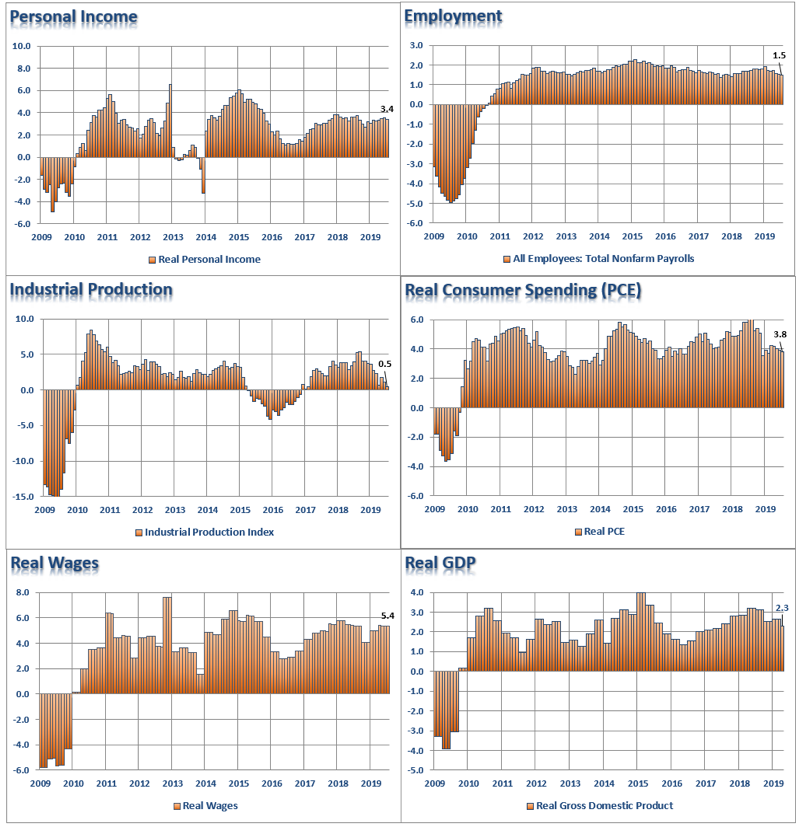

Roberts outlines in the 6 panel chart below how personal income, employment, industrial production, real consumer spending, real wages and real GDP are all weakening in the U.S.:

Trillions of dollars of monetary stimulus has not created prosperity for all. The chart below shows how liquidity fueled a dramatic increase in asset prices while world GDP declined by about 25 %:

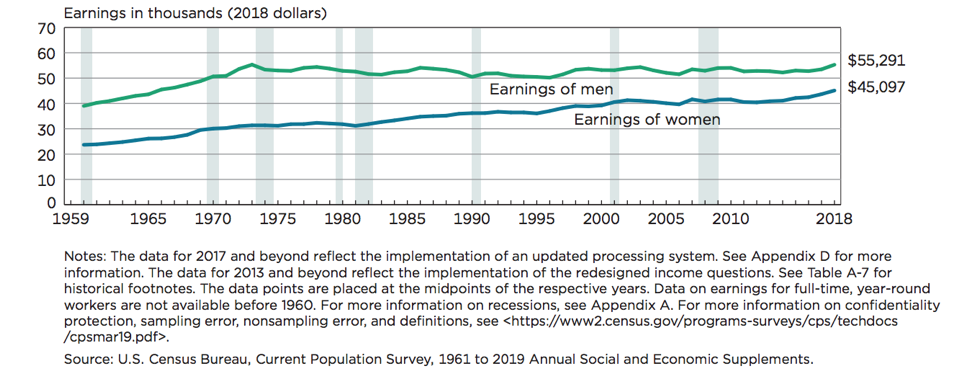

There are a number of reasons monetary stimulus by itself has not lifted the incomes of the middle class. One of the major reasons is stimulus money has not translated into wage increases for most workers. U.S. real earnings for men have essentially been flat since 1975, while earnings for women have increased though basically flat since 2000:

If monetary policy is not working, then fiscal investment from private and public sectors is necessary to drive an economic reversal. But, will private and public sector sectors have the necessary tools to bring new life to an economy in decline?

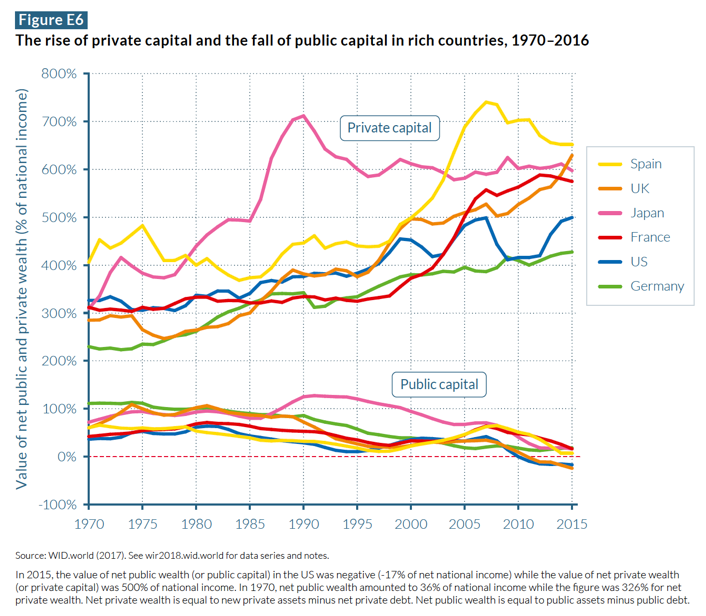

Wealth Creation Has Gone to the Private Sector

The last 40 years has seen the rise of private capital worldwide while public capital has declined. In 2015, the value of net public wealth (or public capital) in the US was negative -17% of net national income while the value of net private wealth (or private capital) was 500% of national income. In comparison to 1970, net public wealth amounted to 36% of national income while the for net private wealth was at 326 %.

Essentially, world banks and governments have built monetary and fiscal economic systems that increased private wealth at the expense of public wealth. The lack of public capital makes the creation of public goods and services nearly impossible. The development of public goods and services like basic research and development, education and health services are necessary for an economic rebound. The economy will need a huge stimulus ‘lifting’ program and yet the capital necessary to do the job is in the private sector where private individuals make investment allocation decisions.

Why is building high levels of private capital a problem? Because as we have discussed private wealth is now concentrated in the top 1 %, while 70 % of U.S GDP is dependent on consumer spending. The 90 % have been working for stagnant wages for decades, right along with diminishing GDP growth. There is a direct correlation between wealth creation for all the people and GDP growth.

Corporations Are Not In A Position to Invest

Some corporations certainly have invested in their businesses, people and technology. The issue is the majority of corporations are financially strapped. Many corporate executives have made profit allocation decisions to pay themselves and their stockholders well at the expense of workers, their communities and the economy.

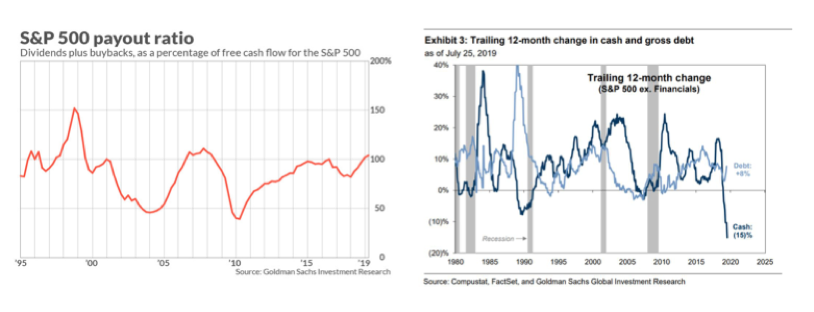

S & P 500 corporations are paying out more cash than they are taking in, creating a cash flow crunch at a – 15 % rate (that’s right they are burning cash) to maintain stock buyback and dividend levels:

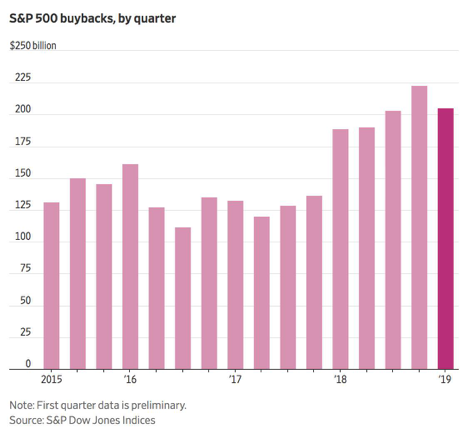

In 2018 stock buy backs were over $1.01 trillion are at the highest level they have ever been since buybacks were allowed under the 1982 SEC safe harbor provision decision. It is interesting to consider where our economy would be today, if corporations spent the money they were wasting on boosting stock prices and instead invested in long term value creation. One trillion dollars invested in raising wages, research and development, cutting prices, employee education, and reducing health care premiums would have made a significant impact lifting the financial position of millions. This year stock buybacks have fallen back slightly as debt loads increase and sales fall:

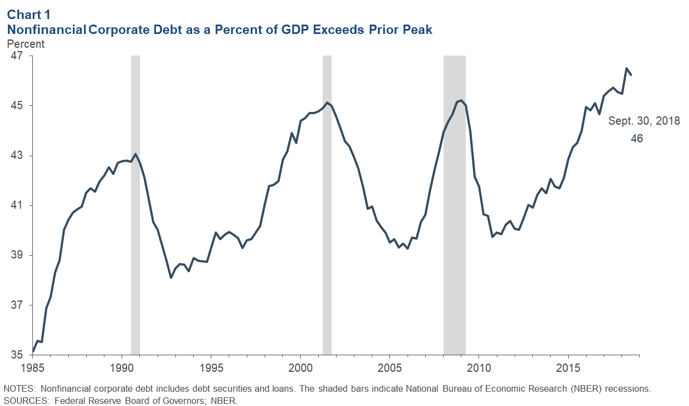

Many corporations with tight cash flows have borrowed to keep their stock price elevated causing corporate debt to hit new highs as a percentage of GDP (note recessions followed three peaks):

Corporate debt has ballooned to 46 % of GDP totaling $5.7 trillion in 2018 versus $2.2 trillion in 2008. While the bulk of these nonfinancial corporate bonds have been investment grade, many bond covenants have become lighter as corporations seek more funding. Some bond holders may find their investment not as secure as they thought resulting in less than 100 % return of principal at maturity.

In a recession corporate sales fall, cash flow goes negative, high debt payments become hard to make, employees are laid off and management is trying to hold on. Only a select set of major corporations have cash hoards to ride out a recession, others may be able obtain loans at steep interest rates, if at all. Other companies may try going to the stock market which will be problematic with low valuations. Plus, investors will be reluctant to buy stock in negative cash flow companies.

Thus, most corporations will be hard pressed to invest the billions of dollars necessary to turnaround a recession. Instead, they will be just trying to keep the doors open, the lights on, and maintain staffing levels to hold on until the day sales stop falling and finally turn up.

Public Sector is Tapped Out Too

In past recessions, federal policy makers have turned to fiscal policy – public spending on infrastructure projects, research development, training, corporate partnerships and public services to revive the economy. When the 2008 financial crisis was at its peak the Bush administration, followed by the Obama government pumped fiscal stimulus of $983 billion in spending over four years on roads, bridges, airports, and other projects. The Fed funds interest rate was at 5.25 % at the peak, so interest rate reductions had a significant impact versus today at 2.25 %. It was the combined monetary and fiscal stimulus that created a V-shaped recession with the economy back on a path to recovery in 18 months. It was not monetary policy alone that moved the economy forward. However, the recession caused lasting financial damage to wealth of millions. Many retirement portfolios lost 40 – 60 % of their value, millions of home owners lost their homes, thousands of workers were laid off late in their careers and unable to find comparable jobs. The Great Recession changed many people’s lives permanently, yet it was relatively short lived compared to the Great Depression.

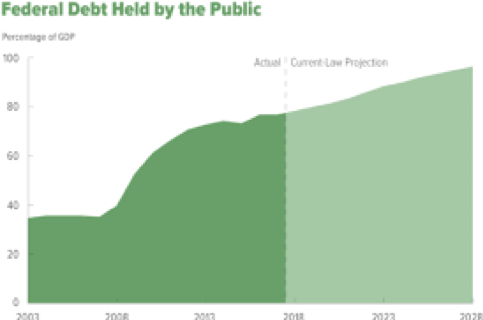

As noted in the chart above, public sector wealth has actually moved to negative levels in the U.S. at – 17 % of national income. Our federal government is running a $1 trillion deficit per year. In 2007, the federal government debt level was at 39 % of GDP. The Congressional Budget Office projects that by 2028 the Federal deficit will be at 100 % of GDP.

We are at a different time economically than 2008. Today with 80 % of GDP public debt, a Fed balance sheet with $4 trillion while the federal debt level is projected to grow to 100 % of GDP by 2028. In a recession federal policymakers will likely make spending cuts to keep the deficit from going logarithmic. Policy makers will be limited by the twin deficits of $22.0 trillion national debt and ongoing deficits of $1 trillion a year eroding investor confidence in U.S. bonds. The problem is the political consensus for fiscal stimulus in 2008 – 2009 does not exist today, or probably even after the 2020 election. Our cultural, social and political fabric is so frayed as a result of decades of divisive politics it is likely to take years to sort out during a recession. Our political leaders will be fixing the politics of our country while searching for intelligent stimulus solutions to be developed, agreed upon and implemented.

What Will the Next Recession Look Like?

We don’t know when the next recession will come. Yet, present trends do tell us what the structure of a recession might look like, as a deep U- shaped slow period over years, hurting the poor and working class the hardest:

- Corporations Short of Cash – Corporations already strapped are short on cash, lay off workers, pull back spending, are stuck paying off huge debts.

- Federal Government Spending Cuts – The federal government caught with falling revenues from corporations and individuals, is forced to make deep cuts first in discretionary spending then social services and transfer funding programs. The reduction transfer programs will drive slower consumer spending.

- Consumers Pull Back Spending – Consumers will be forced to tighten budgets, pay off expensive car loans and student debt, and for those laid off seeking work anywhere they can find a job.

- World Trade Declines – World trade will not be a source of rebuilding sales growth as a result of the China – US trade war, and tariffs with Europe. We expect no trade deal or a small deal with the majority of tariffs to stay in place. In other words, just reversing some tariffs will not be enough to restart sales. New buyer – seller relationships are already set closing sales channels to US companies. New country alliances are already in place leaving the US closed out of emerging high growth markets. A successor Trans Pacific Partnership (TPP) agreement with Japan and eleven other countries was signed in March, 2018 without the US, China is negotiating a new agreement with the EU. EU and China trade totals 365 billion euros per year. China is working with a federation of African countries to gain favorable trade access to their markets.

- Pension Payments in Jeopardy – Workers dependent on corporate and public pensions may see their benefits cut from pensions which are poorly funded today. GE announced freezing pensions for 20,000 employees, the harbinger of a possible trend that will reduce consumer spending

- Investment Environment Uncertain – Uncertainty in investments will be extremely high, ‘get rich quick’ schemes will flourish as they did in 2008 – 2009 and 2000.

- Fed Implements Low Rates & QE – The Fed is likely to implement very low interest rates (though not negative rates), and QE with liquidity in abundance but the economy will have low inflation, and declining GDP feeling like the Japanese economic stasis – ‘locked in irons’.

- Unemployment Soars – workers in low wage jobs, support, non-core (HR, IT, Admin) jobs will be laid off first. Industries already weak in the economy feel the downward spiral the most: retail, materials, manufacturing, and energy. As the recession deepens, small businesses that can not get loans to get through the rough times so they close. Even medium businesses are hit hard, as they do not have the access to worldwide markets to offset declining US sales. The rate of multiple job holders is at an all time high now, it will continue to soar as workers try to sustain their standard of living in a contractor economy with no safety net for workers.

Next Steps:

A recession of the magnitude we expect will hit the middle class hard as they are the most vulnerable. Their wages have been flat for most of the decade while the top 10 % have enjoyed the majority of income and wealth increases. Due to the private sector holding most of the positive wealth in the U.S. a new approach to simulating the economy will be necessary.

1.Corporate Stimulus

While most corporations will be cash poor, some companies will be cash rich. Firms like Apple, Alphabet (Google), Microsoft all hold over $100 billion in cash. Cisco and Oracle both have over $50 billion cash on hand. These tech giants hold most of their cash overseas. To spur spending in the right places for the economy, tax laws could be passed to reduce taxes when repatriated funds are spent on employee development, research and development, productivity and wage increases. Google, Facebook, and Apple have taken a good first step on housing, with all three donating about $4 billion to housing programs. While housing may not seem like a ‘public good’ it has become a major issue in the San Francisco Bay Area from high growth businesses and long commutes to inexpensive housing 2 hours away. We would like to see the emergence of the ‘servant’ CEO from these companies and others in sectors of the economy with cash like banking, pharma, and health insurance. Over 180 Business Roundtable executives released a declaration that corporations need to take responsibility for their communities, not just seeking profits. The introduction to their statement notes

“Americans deserve an economy that allows each person to succeed through hard work and creativity and to lead a life of meaning and dignity. We believe the free-market system is the best means of generating good jobs, a strong and sustainable economy, innovation, a healthy environment and economic opportunity for all.”

Ensuring economic opportunity for all means corporate executives make investments in the future financial health of their communities. Business leaders can take the lead by ending stock buybacks which totaled $1.01 trillion last year and investment those funds in employee development, pension plans, price reductions, productivity enhancements, maintain staffing levels and innovative research. Otherwise the safe harbor policy the SEC approved in 1982 can be revoked to prod executives to make investment decisions to ensure the future of both their businesses and communities.

2. Transfer of Private Wealth and Income to Public Sector

Wealthy business people and individuals can take the lead in driving the passage of legislation transferring some wealth back to the public sector. In November, 2017 over 400 millionaires and billionaires sent a letter to Congress to strongly recommend against the passage of the Tax Cut bill which created a $1.5 trillion additional federal deficit while 80 % of the benefits went to the top 5%. We will need more of this kind of active leadership across the political spectrum to make the necessary shift to finance the creation of public goods and services necessary to turnaround a recession. Other wealthy individuals have called for increased taxes on income and wealth of the top 5 to 10 %. Just changing the present tax laws back to 2016 levels would help to boost funding to fund fiscal stimulus programs in innovative ways. There is backing by some wealthy leaders to end the carry tax exclusion that hedge fund managers and others in the financial industry use to reduce taxes.

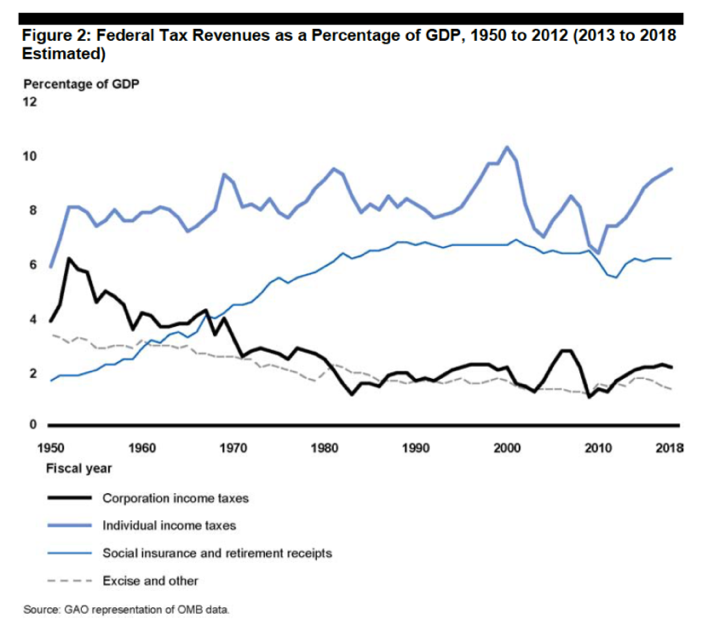

Taxes as a percentage of profits has continued to fall from 1960 at 45 % to 15 % in the last year. Corporate lobbying of Congress worked to reduce company tax rates, create loopholes and subsidies for some industries.

Corporate taxes can be evaluated as a percentage of GDP as well where it is clear corporations were able to lower their federal tax burden from a peak of 6% in 1955 to a low of 2 % in 2012 a 66 % reduction, and is estimated to be lower with the Tax Cut Bill of 2017 lowering the standard tax rate from 35 % to 22 %. The GAO in 2012 evaluated all the tax law benefits and deductions corporations enjoyed and found the effective tax rate was really 12.9 %. Today, the effective tax rates is even lower as corporate federal tax receipts fell to an all-time low of $204 billion for fiscal 2018 a 31 percent decline from 2017. Some corporations are paying no federal tax at all. Amazon declared $11 billion in income for 2018 and paid no taxes.

One way corporations evade US taxes is by depositing billions in profits in offshore tax havens to shelter their profits from taxes.

Clearly the use of tax havens needs to end, as our federal government is losing billions of dollars of receipts to invest in the public goods this country so desperately needs.. Corporate taxes raised and loopholes plugged make sense to begin shifting the necessary funds over to the federal government.

The tax legislation process is critical for long term success and support. Bringing corporate taxes back to levels seen over a decade ago would go a long way toward reducing the federal deficit and fund public services at necessary levels to create more economic opportunities for all. Multiple points of view across the political spectrum need to be sought out and brought together in a special congressional committee focused on writing a fair tax bill to get the federal budget on a firm foundation and fund Medicare and Social Security programs.

3, Deploy Innovative Multi Partner Economic Innovation Programs to Solve Economic Challenges – Heartland Region Development

At the heart of political divisions in our country today is the decline of a strong middle class and economic inequality at the highest level since 1929. Building a strong middle class that enjoys the economic benefits of a secure home, job, health care and safe community will result in people seeing a common good emerging for everyone. Monetary policy has failed to provide economic benefits to the middle class, while boosting the values of financial assets largely held by the top 1%. If a recession comes, what will happen to the middle class, and vulnerable people in our economy?

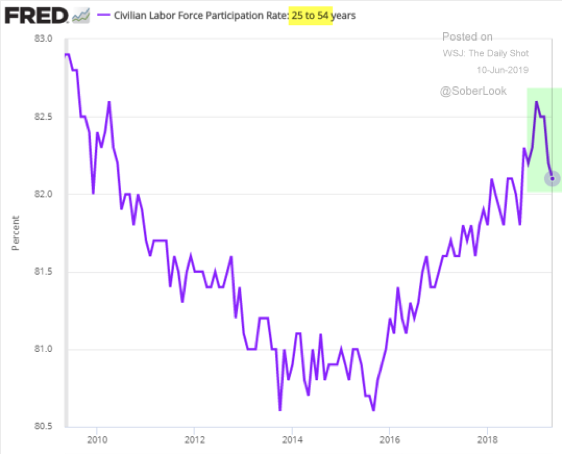

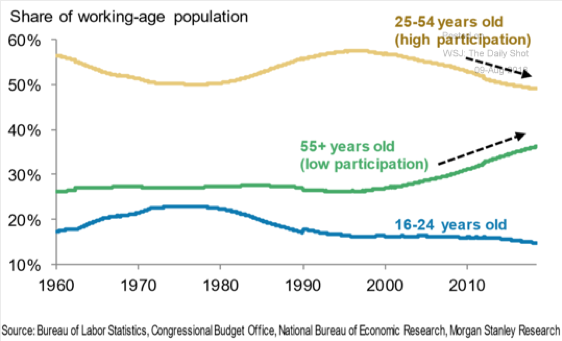

It is unlikely given the present financial structure of our economy that monetary policy alone which has failed the middle class with stagnant wages will somehow turn the economic status around for the middle class. The decline of the middle class is happening in parallel with a fall in GDP to 1.9 % forecast for the 3rd quarter of 2019. Part of the decline in GDP is associated with a declining labor participation rate. There were 7.6 million job openings, last January with more than 8.6 million unemployed for a gap of 1 million jobs. This gap started in the spring of 2018 for the first time in 18 years. Part of the reason for the gap between job openings and job seekers is the imbalance in our labor force by skills and regional limitations. Millions are not working due to lack of education, skills, health, lack of child care or limited work opportunities in their area. For the core workforce between ages 25 – 54 the participation rate recently has been declining since the peak in 2000.

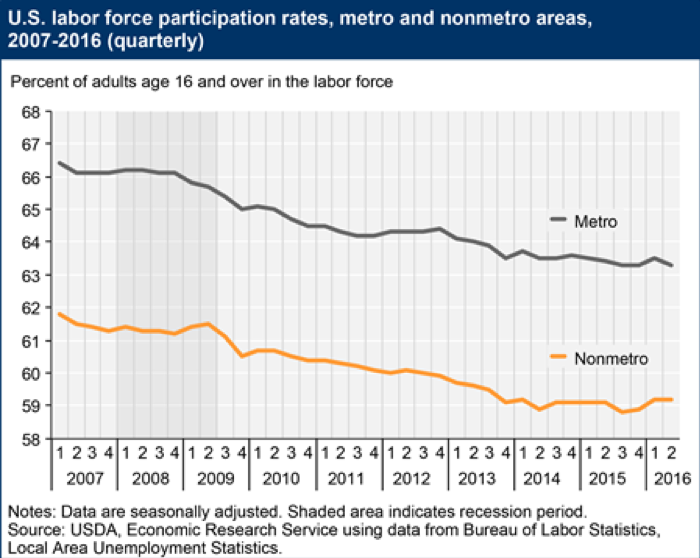

The most vulnerable regions are in non-metro areas of our country where the economic boom on the coasts and big cities has passed them by. Research indicates a key contributing factor to the decline in participation of 18 – 24 years old group is the lack of young workers in non-metro regions.

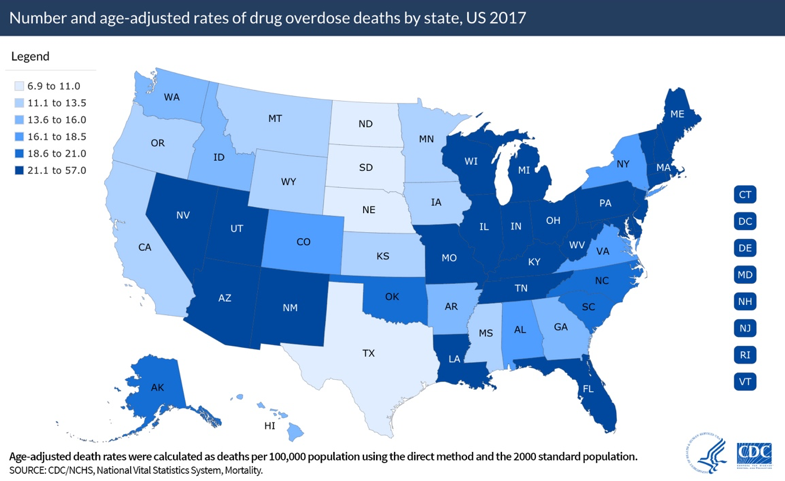

Poverty remains a major issue in rural areas of the country, Midwest and South. These areas have lost millions of manufacturing jobs due to automation and moving factories offshore. Lack of economic health, forces supporting businesses to leave, closing of hospitals and support services. The opioid epidemic is highest in rural regions of the country.

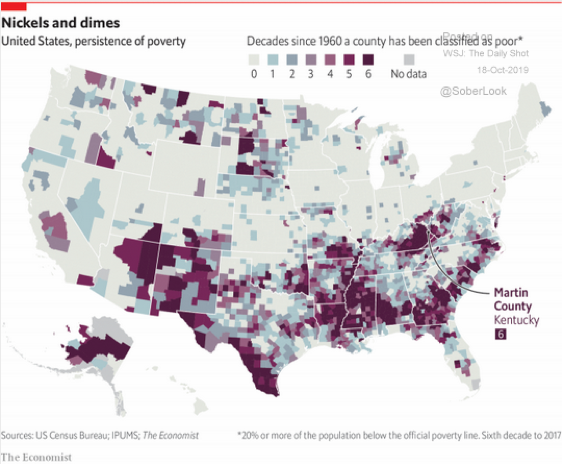

Many of these rural, Midwest and Southern counties have been left out of the economic mainstream for decades as noted by the darkest purple areas of the chart. While, there single factor programs like enterprise zones with reduced taxes, or innovation institutes at major land grant universities we have not seen multi-factor programs that give a ‘focused force’ of economic impact necessary to turnaround these regions. The Heartland was chosen for the first implementation in addition to the reasons above, there are additional cultural, health and education issues that need to be addressed.

The Heartland is where: (1) mobility to take new jobs is the lowest in rural and small cities in the Midwest and South (2) there is the highest concentration of young people without a 4-year degree (3) the lowest concentration of entrepreneurs is holding back business formation and development to create new higher paying jobs with a future (4) the largest number of people without health insurance are found in the South and rural areas of the Southwest and West (5) slow speed Internet connections are the norm leaving many heartland regions way behind in the digital revolution where new jobs, opportunities for education and quality health are being developed and accessed (6) accounting for births, deaths and migration rural population has declined for five consecutive years. It is deplorable that a complete socio-economic region of the country has so many factors that have not been addressed to extent necessary to transform people’s lives toward good health and fair share of prosperity.

Rural and small town America enjoyed a renaissance of increasing jobs and prosperity into the mid 1990s. During this time rural counties were home to more than one-third of all net new businesses establishments fueling the job creation engine. Yet, in the past ten years the economic conditions have changed dramatically, leaving these regions out of robust growth in coastal areas since the Great Recession. For more details and research please read our blog: The Hallowing Out of Heartland America.

We think that the multi-partner program outlined below besides working in rural regions will work as well in economically depressed neighborhoods of our inner cities on the coasts or major cities of the Midwest with local modifications to take into account cultural, ethnic and societal differences.

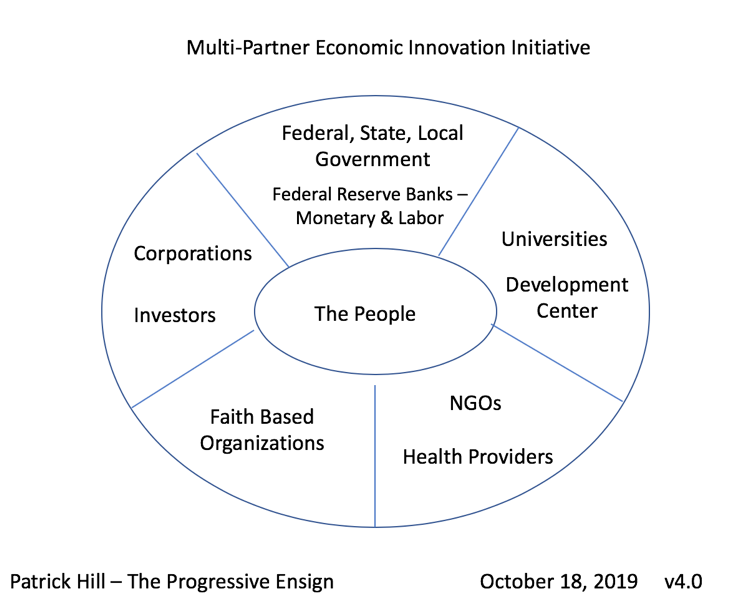

The Multi-Partner Economic Innovation Initiative

The Silicon Valley innovation process is a multi-organization model used as a base for the Multi-Partner Economic Innovation Initiative (MPEII). Universities working as incubators, with investors, local and state government support, investors, highly educated workforce, and immigrants all contributed to making the Silicon Valley model successful in giving birth to Google, Facebook, Apple, LinkedIn, Twitter, and hundreds of other companies. We have added other necessary elements to jump start a slow growth economic regions like non-government organizations providing training or recovery services, health providers to take on major issues like opioid addiction, faith-based organizations for counseling and financial assistance. Finally, federal government agencies will need to play a key role in turning around a slow growth region vulnerable in a recession to a spiraling down turn. We introduce the idea of a Federal Reserve Labor Bank, organized much like the present Federal Reserve for monetary policy yet with a charter to constantly build and renew our labor force for unimagined new jobs.

The MPEII would be structured as a non-profit corporation with representatives from all the organizations necessary to drive the coalition to success in meeting the economic objectives of the region. The federal government rather than building a large bureaucracy would seed the development of the MPEII entities called Development Centers with $25 – 50 million, joined by corporate foundations, local and state government and social entrepreneurs. In our first imitative The Heartland Development Center (HDC) is the central innovative entity bringing all the partners together and taking leadership to drive solutions in rural regions. The HDC is formed as an investment organization, putting out a call for business plans from local social entrepreneurs to solve a local regional problem with the help of the MPEII organizations. The economic goals could be achieved by profit making companies or non-profit organizations where making a profit is not appropriate or not fitting within the development goals.

The People – At the center of this economic imitative are the people. The voter participation level during the 2018 – mid-term election hit a 50 year high at 47.5 % with 110 million Americans voting in congressional races. This engagement in the political process at the local, state and federal is crucial if we are to develop the consensus moving forward to solve our economic problems. Voters need to demand that corporate, private investors, government and related organizations needs to change polices to focus on building the middle class, protecting our environment, cutting the costs of education and ensuring equal opportunities and a level playing field for all that participate in our economy. In our Heartland example implementation to bring our rural and southern regions into the economic mainstream, local communities, and leaders from multiple institutions need to be involved in making the changes necessary to bring a lasting economic boost to the Heartland.

Universities – The HDCs in selected rural and southern regions would be located in nearby universities for support to be forward looking with local students and professors – consultants as core staff along with local leaders to solve major challenges. The Heartland Development Center acts as a catalyst creating an innovation ecosystem to jumpstart local economics and social structures. HDCs would focus on all the key issues that a region needs to address to rebuild their economy and people’s lives: business formation, education and training, digital infrastructure, affordable housing, engaged local innovation media and health care. There already is an imitative by Congressman Ro Khanna, to fund a modern version of the Morrill Act, that funded the development of land grant universities to support agricultural development in the U.S in 1862. Fifty universities would receive grants of $50 – 100 million to fund technology centers to focus on training and development programs for 21st century jobs. This bill is a good start, the HDC is extension of this imitative to provide a ‘focused force’ on solving regional economic problems and create an innovation ecosystem that is self-renewing.

Federal, State, Local Government – Federal government funding is necessary for a cross regional program with multiple components along the scale of the Marshall Plan after WWII for re construction of Europe. State and Local governments have the local knowledge, leadership and links to local universities, health providers and non-government organizations that will be helpful in forming the consensus required to focus people and resources on the key problems with workable solutions. The Federal Reserve has analysts who have completed research and continue to monitor the economic health of the 12 Federal Reserve districts that will be helpful to base programs on patterns in the facts. We propose that a pilot ‘Federal Labor Reserve Bank’ (FLRB) be created in the 12 districts to focus on the labor issues, composed of governors in the 12 areas with labor expertise in corporations, universities or labor leaders. The FLRB would set minimum wages for key regions conduct studies like the Fed beige report, called a ‘lavender’ report on the health of the workforce in each region. The report would identify key labor trends, wage issues, and obstacles to creating a thriving workforce. The FLRB would offer loans to key entities with assistance from the Federal Reserve to providing of key training and development initiatives, in a timely manner. The FLRB’s mission is to build a thriving labor force and take on major challenges like identifying why the labor participation rate is so low compared to pre – 2008 levels and implement programs accordingly to increase the rate. Every month the FLRB would review how well it is doing in achieving goals of increased labor participation rate, increasing wages for the middle class and other goals as established by the Governors.

Corporations & Investors – Companies in these slow growth regions need support in multiple areas that are unique to the economics of each area. Major employers should be included in the steering councils of the HDCs to provide valuable local guidance to HDC leaders on where to focus resources, training for job candidates and the product and sales direction of their businesses. Many corporations have investment groups and can be invited to participate in the HDC program, to achieve results for their business that they are willing to share with the community. Venture capitalists, angels and private equity firms will be encouraged to participate and may be invited to be on the HDC steering council. Telecom firms need to be invited to bid on digital infrastructure projects which may be funded by government grants. It is likely that some of these Internet projects may not be profitable for telecom companies or they would have already laid the fiber optic cables and setup the links to homes in these areas. Like the Rural Electrification program in the 1930s, the digital infrastructure must be in place for rural areas to gain fast access to the Internet. Plus, high speed Internet access is a requirement to build innovation centers and create businesses with 21st century high technology jobs.

Non-Government Organizations, Foundations & Health Providers – Health services in many rural regions has deteriorated along with companies leaving the loss of jobs. Unemployment rates are often twice the national average. The lack of health service providers and hopelessness of not having a job is driving disease and death rates higher. The CDC reports deaths due to cancer, heart disease and respiratory illness are 15 – 35 % higher in rural areas since the Great Recession. A number of communities have no hospital closer than 2 – 3 hours away. Doctors setup a practice based on government rural doctor incentive programs, then leave after they have put in their required tenure. Opioid overdoses are concentrated in rural states and Midwest region.

A health services revitalization plan needs to be developed by region which includes hospitals, clinics and incentives for doctors to come, stay and build a practice in reach region. Often, the lack of high speed Internet limits the opportunities for health providers to shift to electronic records, services and even use of tele-medicine which would be helpful to reach out over long distances. Health and job candidate support are related as one research organization found that for many manufacturing employers in Indiana that for factory floor jobs as many as 45 % of the workers tested positive for drugs.

Training, career development, and apprenticeship working closely with universities can make a major contribution in a coordinated effort to put unemployed workers to work. NGO groups like the Opportunity@Work program are one approach to attack the job training challenge. The training group started in the Obama White House focuses on providing Internet economy job training to workers in the heartland to gain digital skills for jobs in fields like programming and information technology.

Colorado has invested in its CareerWiseto bring businesses, colleges and vocational training groups into partnerships providing all Colorado high school juniors and seniors with a dual career path leading to a community college associates degree plus key skills. Students can begin working on the factory floor as juniors learning key company job skills, and are guaranteed full time employment at the end of their apprenticeship along with financial support to earn a community college degree.

Faith Based Organizations – many faith based organizations provide counseling services, welfare, foods services and other resources to those in need. Working closely in the HDCs with their steering councils programs can be coordinated and focused in areas where churches, synagogues or mosques are located. FBO groups often have been in neighborhoods for many years, with a deep understanding of the needs, trends and social issues that are unique to their area. Leaders and staff in the HDC would do well to establish good connections with these groups to gain insights into which programs, services and resources are needed to turnaround the economic situation in their community.

In the end, Americans have always pulled together, solved problems and moved ahead toward an even better future. After a reversion to the mean in our capital markets and an economic recession things will get better. A reversion in social and culture values is likely to happen in parallel to the financial reversion. The complacency, greed and selfishness that drove the present economic extremes will give way to a new appreciation of values like self-sacrifice, service, fairness, fair wages and benefits for workers, and creation of a renewed economy that creates financial opportunities for all not just the few.