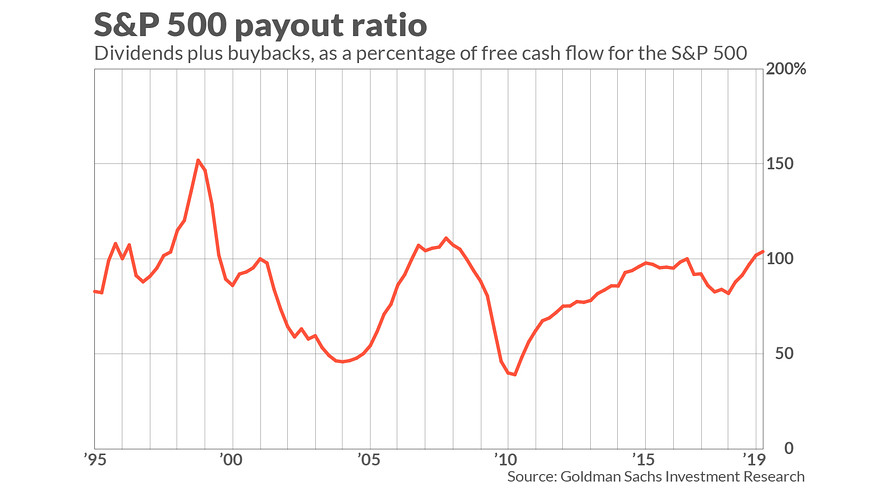

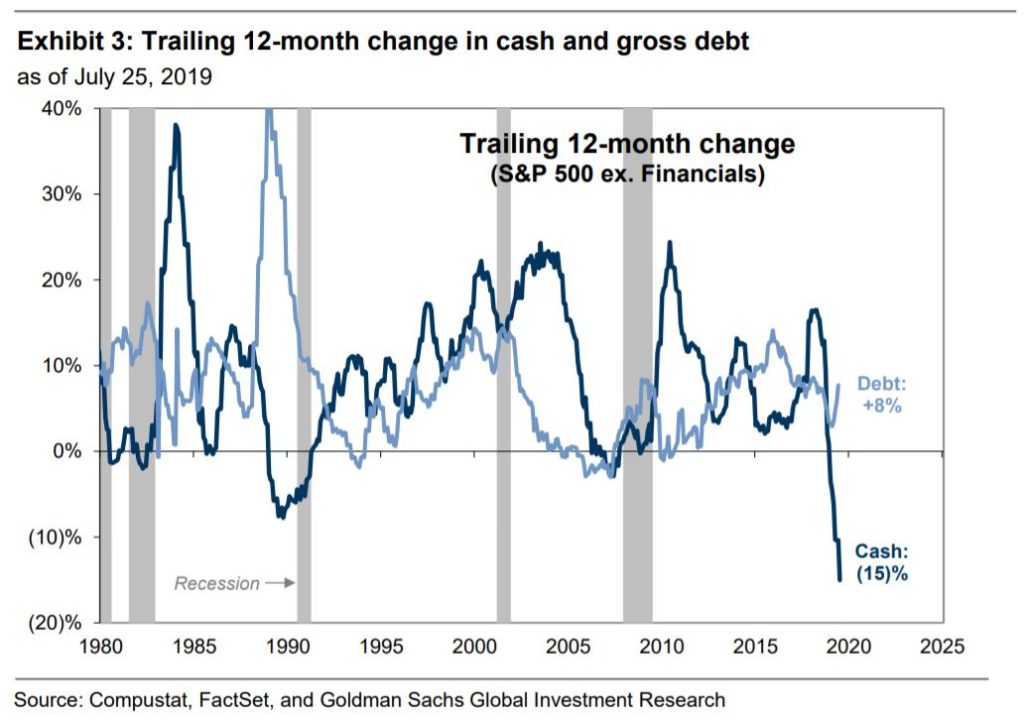

Goldman Sachs just completed an analysis of corporate payouts and found that dividend and stock buybacks were 103.8% of their free cash flow. Meaning that they were paying more out in cash than they had on hand! Free cash flow has dropped to – 15 %, while debt is up 8 %.

This squeeze is unprecedented, it is the worst cash flow crisis since 1980, and is unsustainable. Corporate executives have turned to extremely high borrowing levels to keep this financial merry-go-round going. While, turning to stock buybacks to hype the price of their stock and keep earnings per share high to the tune of $1.5 trillion by S & P 500 companies in the last year.

If sales and profits drop due to the trade war and consumer spending declines as it has in the last four months, corporations will default on their debt. A downward economic spiral will be triggered.

Maybe this is another reason the Fed announced a cut in interest rates and shift to an ‘inflation averaging framework’. JPMorgan recently commented to Marketwatch they believe Fed economists are shifting to a position of not worrying about inflation but instead on keeping money flowing to corporations at low interest rates possibly to zero. By keeping rates super low the Fed is enabling executives to waste profits on stock buybacks to hype their pay and stock price. We need strong companies making investments in research, development, innovation, productivity improvements and raising wages for workers. When the economy works for all then democracy is strengthened.

The financial music will stop when sales and profits decline, an already desperate cash flow position becomes untenable putting company viability in doubt. Looking out a year or two, we expect the Fed to come to the rescue after possible zero interest rates have panned out. Last March, former Fed Chair, Janet Yellen recommended that the Fed be authorized to purchase corporate stock and bonds to keep the economy going if a recession hits.