Image: ccdallas.org

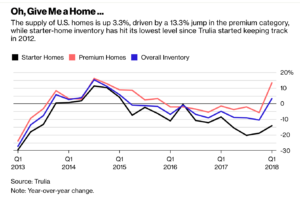

The number of starter homes for first time home buyers has continued to decline over the past six years. Millennial first time buyers are struggling with high student debt loads, car payments and sky high rents. Many young people can’t afford to live on their own and live with their parents into their late 20s and 30s. New household formations are at their lowest level since before the 2008 recession.

Sources: Trulia, Bloomberg – 3/22/18

On top of all the personal finance issues for first time buyers the price of housing continues to sky rocket now at a 7 – 8 % increase year over year. Plus, the GOP Administration has slapped tariffs on Canadian imported lumber a major building material for homes giving a even bigger boost to prices. The difference between incomes for starter home buyers and their incomes continues to spread with the housing affordability index at a 9-year low. For our economy we need a boost in first time buyer homes to increase house formation which will increase sales in home furnishings, appliances, and floor coverings – which are now flat to growing at only 1 to 2 % per year.

Builders make more margin on higher priced homes, so when they have a choice to build a high priced home versus an affordable one they will choose the high priced home. So, how do we provide incentives for builders to build more starter homes, and increase the pool of first time buyers so builders have a good market for starter homes?

Next Steps:

Home builders are business focused, they see a declining number of first time home buyers so they build more high prices homes and they have few incentives from loan providers to build first time homes.

First, we need to mitigate the student loan debt load by refinancing their loans at lower rates, providing more workouts on favorable terms or for public service out and out forgiveness of the loan.

Second, the lumber tariff needs to be ended, so we can balance lumber markets between the US and Canada to reduce lumber prices

Third, we need to work with federal home loan agencies to finance more first time homes on more favorable terms, so young couples, or others can purchase their starter home.

When people own a home they take care of it and their neighborhood looks better, they gain an intrinsic sense of reward in caring for their home and making it theirs – renting can never provide that feeling. Home ownership is a key pillar of our democracy building the equality of ownership. Homes need to be available to all to own, not just the wealthy.