(Editor Note: Insight Bytes focus on key economic issues and solutions for all of us, on Thursdays we spotlight in more depth Solutions to issues we have identified. Fridays we focus on how to build the Common Good. Please right click on images to see them larger in a separate tab. Click on the Index Topic Name at the beginning of each post to see more posts on that topic on PC or Laptop.)

Image: marylandpirg.org

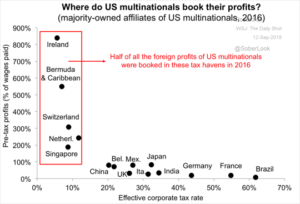

In 2016, multinational U.S. corporations booked over 50 % of their foreign profits in overseas tax havens. Whether the profits are made in Casablanca or Singapore corporations are using lax US tax laws and accommodative offshore tax haven laws to book profits where they can’t be taxed at fair share rates. Note that pre-tax profits viewed as a percentage of wages paid ranged from 200 % in Singapore to 800 % in Ireland!

Sources: The Wall Street Journal, The Daily Shot – 9/12/18

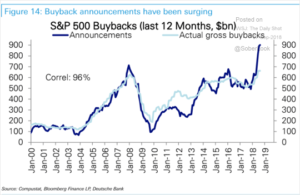

Combine this tax information with the soaring use of stock buybacks by moving dollars from these offshore accounts to juice the price of their stock and we see corporate executives doing a great job of increasing their stock based compensation.

Sources: Compustat, Bloomberg Finance LP, Deutsche Bank, The Wall Street Journal, The Daily Shot – 9/12/18

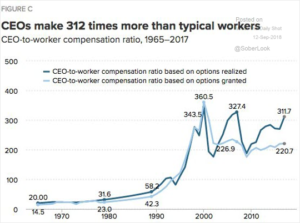

The US stock market has dramatically diverged from overseas markets where China markets are down in bearish territory at 20 % for the year and emerging markets down close to 18 %. Yet, the S & P 500 Index of U.S. stocks is up 7.4 % for the year. With all the uncertainty in emerging country currencies, trade wars, lack of wages, falling home and care sales, the U.S. stock markets keep rising being propped up by stock buybacks. Nearly $1 trillion of buy backs have been announced for the year. Buy back dollars are not going toward raising employee wages which are 312 times lower than CEO wages.

Sources: The Wall Street Journal, The Daily Shot – 9/12/18

Little wonder workers are not getting a fair wage in many industries with corporate executives stashing money overseas where it is out of reach of U.S. tax laws. Plus, executives are compensated for increasing profits, not increasing wages that would cut into profits.

Next Steps:

Corporations received a windfall from the Tax Bill last year which did not change taxation of U.S. corporate profits overseas, but instead gave corporations a huge one-time tax break on repatriated funds from the listed rate of 35 % to 15.5 % for cash related assets and 8% for illiquid assets. Many corporations did bring funds back to U.S. this year, yet 70 % of the funds were used for dividends and stock buybacks. Only a small percentage of repatriated funds went to raising worker’s wages which is what CEOs promised they would do when lobbying for the Tax Bill.

It is time for corporate leaders to understand they need to start paying their fair share of U.S. taxes for entities overseas, and they need to pay a share of the cost of our armed forces overseas. They benefit directly from having safe countries, government protection through embassies and staff and safe passage of cargo worldwide. Plus, the U.S. government working in partnership with corporations provides businesses opportunities that firms from other countries with less presence don’t enjoy. U.S. corporations need to pay up, and recognize profits in their respective countries where they do business with a share going to the U.S. government for the offshore benefits they receive.