Image: mikaeldacosta.com

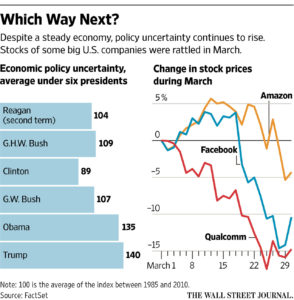

Our President just threw the trade dialog for a loop this afternoon requesting his trade team come up with another $100 billion in tariffs against China on top of the already $50 billion he has announced. He thinks that by starting a verbal trade war with a protracted ‘up to 6 months’ negotiation with China and other countries that the US economy will come out the winner. The winning outcome will likely never happen! Why? Because corporate leaders are already factoring in an incredibly slow negotiation. Corporations abhor uncertainty, the policy uncertainty index with this President is off the charts. Executives are making decisions on investments for the next 3 – 5 sometimes 10 years out into the future.

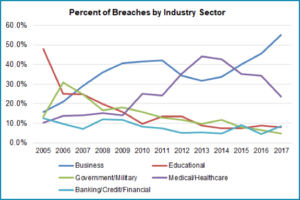

Source: Factset, Stanford, Northwestern, University of Chicago, The Wall Street Journal 4/4/18

Professors Baker of Northwestern, Bloom of Stanford, and Davis of University of Chicago developed an uncertainty index based on mentions of ‘certainty’ and ‘uncertainty’ in newspaper articles. With a relatively quiet economy and the first 12 months of President Trump’s administration now behind us, we expect the ‘uncertainty’ mentions to soar with trade war, stock market prices falling and cross industry conflicts about which industry should be sacrificed for another one.

The major stock indexes have fallen as much as 10 % year to date and yesterday, the Dow Jones Average was on a roller coaster down as much as 510 points then closing at 210 points up at the close. Money managers hate uncertainty too, as they need to make daily decisions in regard to investments of millions of dollars in trusted to them to grow for retirement programs, trusts, endowments and investors looking out 5 and 10 years.

The present trade war was started by our President because he said it would be ‘easy to win.’ Yet, he has little experience in complex global product and services trade. Treaties that he is ready to tear up took years to negotiate, analyze the complex trade data and gain buy in from all parties.

Executives are looking at data, researching alternatives, hiring consulting firms and looking to figure out a long term plan now – with alternatives if the trade war is won by the US or if it is lost by the US or their industry. They will make decisions based on the present level of ‘uncertainty’ and see alternatives now, not waiting to see the outcome. Business leaders cannot wait, they have businesses to run today, shareholders to report to, employees to manage, and products or services to build and sell.

In the steel sector, companies in the US are already stockpiling steel before the tariffs on imports start, spiking prices then there will be a glut of product with prices falling. Soybean farmers in the US already reeling from competition from Brazil and other countries will feel the immediate fall of sales from China, as Chinese customers seek lower cost ‘safe’ non US suppliers for products like pork. Pork futures prices that farmers use to price their hog products have already dropped 15 % in the last month and a deep spiral down of 2.58 % today. Prices are already dropping customers and suppliers are making decisions to reduce uncertainty and these decisions will cause market chaos leading to a recession or worse.

Next Step:

We need to wind down the brinksmanship now, focus on the real issues behind trade imbalances that have been developing for decades, and confront intellectual property theft on a straight on policy basis not through tariffs. We need to use the international forums like the WTO that have been carefully built over the past 50 years to ensure prosperity across the world for all economies and at the same time protect US worker jobs, incomes and future career opportunities. We have said in previous posts that the time is now to reverse direction before it is too late and the global economy is severely damaged.