(Editor Note: This is the first in a series of posts on the state of the job market, and the changing balance of power between workers and management in the Internet Economy, right click on all charts to enlarge in a separate tab)

The View:

When management gains the upper hand and establishes sustained wage power, old economic theories collapse – like the idea that a low unemployment rate meant more wage bargaining power for workers but not anymore. For example, at the time of hire, wages are a negotiation between management and the candidate for a job. The employer has options if the candidate does not accept the offer to seek a variety of candidates from the Internet. After hiring, the employee enjoyed increased power due to his/her performance and value to other employers. However, assuming job performance is sustained now a variety of factors outside job performance are holding wages down. In the Internet Economy, workers face a daunting set of factors reducing their bargaining power – diminished bargaining units (unions decline), automation, fewer jobs at merged corporations, temporary jobs in the gig economy, reduced productivity, increased executive pay and corporate control of job markets. The Action: political forces are gathering to increase worker bargaining power with initiatives like these: placing workers on corporate boards, limit outsourcing, eliminate low wage H-1B visas, offer incentives for corporations to invest in productivity improvements, end stock buybacks, breakup oligopolies, balance the job market process, balance workers and executive pay, fund worker training and increase wages related to robot deployment.

The Story:

This author was hiring a support manager for a customer support community of 5,000 users a few years ago. It was a senior position, it took three months of 3 round interviews, background checks, management review and signoffs to create a candidate job offer. The candidate came back with a counter offer (not unusual in Silicon Valley) of 4 % more and a little more in stock options. I asked my manager how far we could go to meet his counter, the executive’s reply, “We don’t make counter offers, everyone wants to work for us, you have 400 resumes from the Internet on this job, 100 are qualified, just go back to one of them.” This candidate did not have much bargaining power in the job market few years ago and with increasing job market automation candidates have even less bargaining power today.

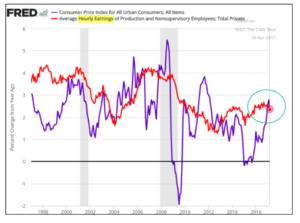

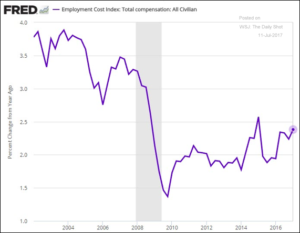

The Bureau of Labor Statistics for last March charts wages versus inflation illustrating how workers experience stagnating wages for 8 years since the great recession – they aren’t getting ahead with wages barely keeping up with inflation recently. In June this year, total compensation including bonuses and commissions has stayed under 2.5%, note prior to the recession it was close to 3.5 % :

Source: Federal Reserve Bank St. Louis, The Wall Street Journal, The Daily Shot – 4/5/17

Source: Federal Reserve Bank St. Louis, The Wall Street Journal, The Daily Shot – 7/10/17

So, how have workers lost their wage bargaining power over the past thirty years?

Unions

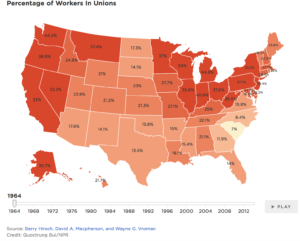

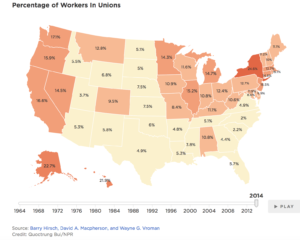

Fifty years ago 33 % of all US workers were members of a union, by 2015 membership had declined to just 10 % – a greater than 66 % decline. The decline was quite pronounced in ‘right to work’ states in many in inland regions and the South:

Source: NPR 2/23/2015

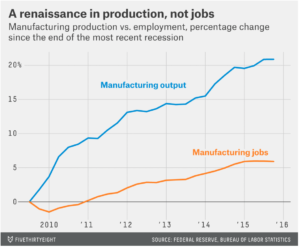

Manufacturing jobs were heavily unionized, yet declined due to automation and productivity increases primarily in electronics and automotive industries where many factories were moved overseas. Almost 5 million manufacturing jobs have disappeared since 2000, yet over the past few years factories have been coming back to the US by increasing employment by 5 %, but with far fewer workers and the US taking the No. 2 position in worldwide manufacturing output with a 20 % increase in output:

Source: FiveThirtyEight, Federal Reserve Bank, Bureau of Labor Statistics – 3/2016

Automation

Thus, while union membership has declined mostly due to the reduction of manufacturing jobs in the US, automation has been a key factor weakening the worker wage bargaining position. A recent Ball State University study found that over 88 % of lost manufacturing jobs were due to automation and productivity increases not offshoring.

Automation started decades ago, as IT applications deployed in offices and manufacturing plants in the 1970s and 80s displaced thousands of workers performing repetitive manual tasks such as data gathering and reporting, answering phone calls, editing and copying documents, sending and receiving status reports, manufacturing reporting and others that were easily automated by software. By 1995, the Internet began to impact the workplace, networking software applications so that jobs once requiring local support or data could be performed overseas for far less. In Silicon Valley, an entry level software engineer would be paid $65 – 75 @hr., while an engineer in India was paid $20 @hr. or less. Thus, most business processes for ‘non-core’ functions like accounting, IT, customer support and benefits processing were moved offshore to reduce costs by 50 – 75 %.

In addition, major corporations have been outsourcing non-core services to US contracting companies to the detriment of worker’s pay security or benefits. For example, in Silicon Valley starting in the 1980s until present – many core IT functions were outsourced with ‘facilities management’ agreements, where IT workers are fired, and rehired by outsourcing companies at 30 – 40 % less in salary with no benefits or health insurance. The workers were faced with no good choice – look for another job or take a pay and benefits cut for the job they had before. In the Bay Area, H1-B visas are often used to keep wages low by offering a worker from India 40 % of the local prevailing wage for a software engineer.

Automation investments continue as software firms develop applications that automate many business activities previously thought to be difficult to automate:

Source: McKinsey Global Institute – 2/28/2017

Jobs requiring skills from sensory perception fine motor activity or navigation are going to be automated over the next 30 – 50 years. All this investment in automation results in less competition for employers to find employees to do the work they need – a machine will do it. The machine shows up on time, requires no vacation, is not absent, and does not sue the company for management miscues.

Corporate Oligopoly

Another way corporations limit worker job options is by merging with other companies and then laying off workers in the newly combined firm. Since 1997 the average market share for the top four firms in most of 893 industry sectors has increased from 26 % to 34 %. For a tenth of these sectors where the top four firms have 33 % to 66 % market share their revenues have increased by 37 %!

Source: Census Bureau, The Economist – 3/2016

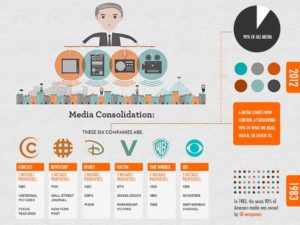

The antitrust section of the Department of Justice has been asleep the past two decades. In the airline industry, there are now 4 airlines that own 80 % of the business. In finance, just 5 banks have 50 % of $15 trillion in total assets. In the information search sector – the top 4 companies have 98.5 % of the search industry market. The wireless communications industry is dominated by the top 4 companies control 94.7 % of the market between them – Verizon, AT &T, Sprint and T-Mobile. In the tire manufacturing sector, the 4 top firms dominate the US market with a total market share of 90.1 %. In 2012, entertainment, media and distribution markets were concentrated in 6 conglomerates with a total of 90 % market share. In 1983, 90 % of entertainment and related markets was distributed over 50 corporations:

Source: mediaculturesociety.org – 1/30/2013

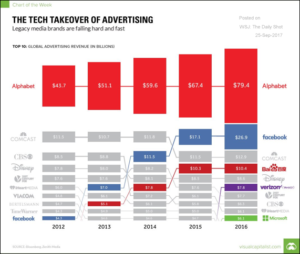

The advertising industry is consolidated into a two Internet behemoths – Google (Alphabet) has nearly 50 % market share and Facebook with 16 %:

Source: Bloomberg, Zenith Media, The Wall Street Journal, The Daily Shot – 9/25/2017

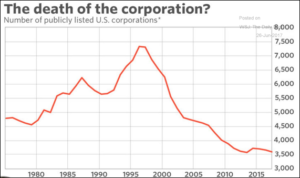

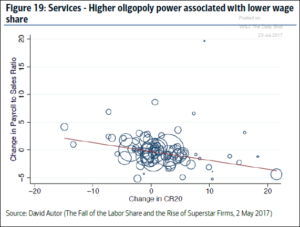

From 1997 to 2017, the number of publicly listed corporations has declined by 50 % overall. Fewer corporations for job candidates translates into fewer corporations offering good paying jobs with high quality benefits. Plus, an analysis of corporate concentration in the five year period of 2007 to 2012 in the services sector, found that where corporations control markets and reduce the number of workers to support sales wages decline.

Source: The Wall Street Journal, The Daily Shot – 6/27/17

Source: David Autor, Professor of Economics, MIT et al, The Wall Street Journal, The Daily Shot 7/23/17

These markets have been turned into oligarchy power centers, where many executives wield huge market and political power – with no interest in increasing wages of employees. Instead, they are motivated to focus on increasing profits (increasing wages would hurt short term profits) by bonus compensation and stock price targets (inducing them to execute stock buybacks).

Gig Economy

The ‘gig economy’ of freelancing and independent contractors has ballooned to about one-third of our workforce or 56 million workers in 2016 according to the McKinsey Global Institute. The growth of ‘shared economy’ companies like Uber, Lyft, Airbnb, Rideshare and many others have provided these gig workers new flexible income opportunities without the financial safety net of traditional employer jobs. Gig economy workers often have limited or no access to worker’s compensation, unemployment insurance, 401K retirement plans, disability insurance or health insurance. Independent workers are required to pay both the worker and company portion of Social Security taxes and worker portion of Medicare each year on their income. In the Gig Economy, 33 % of the workforce is not organized into a union or any bargaining unit. These contract workers they are at the mercy of corporations or businesses that set the terms of a work contract, and if there is a problem they quickly find another contractor with no obligation to the contract worker. Uber, and Lyft dominate the ride sharing market, pushing out taxi cab firms, car companies and shuttle businesses – many with full time employees including benefits. While the cost of rides maybe going down for the passenger, workers are seeing their wages held steady or reduced (Uber reduced driver share of fares by 20 % a year ago) with no compensation for gas costs, auto depreciation and or financial protections. Financial protection for gig economy workers is in the infant stage, where companies are holding off any meaningful changes until class action suits are brought against them.

Productivity

Major corporations have parked over $1 trillion in profits overseas, invested in financial instruments. In 2017, Goldman Sachs estimates S & P 500 corporations will spend over $780 billion in stock buybacks. None of these funds are being invested in the corporation, and its workers to develop new technology, processes or systems to increase productivity or cut costs.

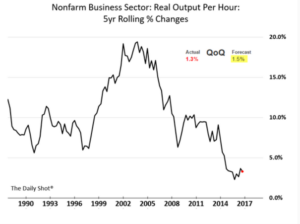

When productivity is anemic, offering wage increases to workers cuts into profits. Executives are compensated well based on hitting profit targets, so wage increases are not going to happen other than low inflation level 1 – 2 % increases. Over the past five years productivity has dropped from 7.5 % to 2.6 % this past year. Interestingly, 2.6 % is the level of wages we see today, stuck at this level for the past three years.

Source: The Wall Street Journal, The Daily Shot – 3/9/17

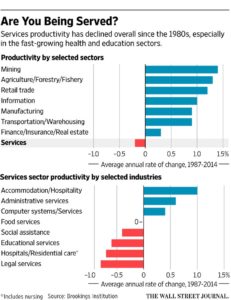

Most of our economy is services based, and productivity improvements in the services sector have been slow in coming compared to the goods based sector. For example in social assistance, education, and healthcare there has actually been a reduction in productivity by up to 9% since the 1980s. Plus, hiring has centered on our services sectors so productivity increases are likely to be limited.

Sources: Brookings Institution, The Wall Street Journal – 10/30/2016

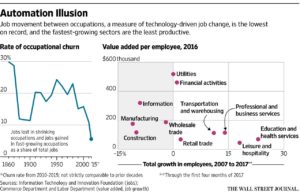

Sources: Information Technology and Innovation Foundation, Commerce Department, Labor Department, The Wall Street Journal – 5/18/17

Executive Pay

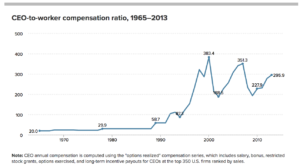

Today, executive compensation at S & P 500 corporations is on average 300 times the average pay of their workers! Senior management enjoys a combination of high salaries, benefits (executive healthcare), house low cost loans, stock options and bonuses for achieving earnings targets. For 2016, CEO average pay increased by 6.8% year/year to a record $11.5 million since the 2008 recession while production worker pay has stagnated at a 2.5 % wage increase.

Source: The Federal Reserve Bank St. Louis, Compustat Exec/Comp Database, Economic Policy Institute – 6/13//2014

Note the ratio of CEO to Worker pay soars in the 1990s with the de-regulation and trickle-down economics of the GOP administration. Extreme executive compensation is taking wages from workers who would otherwise receive their fair share wage. Corporations have committed over $780 billion, according to Goldman Sachs to stock buybacks for 2017 which only go to increase their stock compensation plans and shareholder assets. Those billions of dollars could be better allocated to increasing worker wages.

Worker Pay

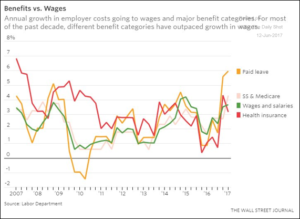

One aspect of worker pay that has increased by 12 % since 2006 is total worker compensation in the form of benefits. While wages have increased by just 4 % in the same period. Paid leave, health and other benefits have grown faster than wages, except in a few months. Wages as a percentage of total compensation have dropped from 70 % in 2006 to 68.3 %.

Sources: Labor Department, The Wall Street Journal – 6/9/17

The health component is somewhat misleading, while corporations have seen increased costs for medical coverage, they have reduced those costs by moving the the majority of cost increases over to employees. Corporations have done this by increasing the deductibles covered, reducing the number of plans and increasing premiums. Worker households are caught in a cash squeeze by having to pay more for the health care coverage they had previously while corporations are holding their costs in line with inflation or slightly more.

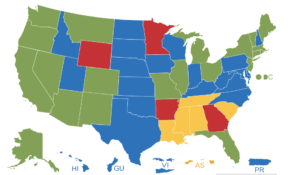

Federal minimum wage laws are not keeping up even with inflation. Some states are making up the difference, by requiring higher minimum wages than the federal minimum wage (green). Other states offer the same minimum wage (blue) and yet in the South many states don’t have any (yellow) wage minimum laws with others (red) below federal minimum wage rates like Minnesota, Arkansas, Georgia and Wyoming. Note many foreign car manufacturers have deployed plants in no wage minimum states like Tennessee, Alabama and South Carolina.

Source: Department of Labor – 1/1/2014

Job Market Automation

LinkedIn was designed for corporate recruiters with the features and services they wanted to speed the recruiting process. The edge to recruiters is obvious in the design of the service. For example job seekers cannot have multiple resumes or experience sets styled toward different jobs. Unless the candidate – user is adept at settings updates to profiles are immediately sent out to all people in their network. Recruiters have dashboards with filtered candidate lists around search preferences and locations. The majority of LinkedIn’s revenue is from the corporate recruiting market – candidates are promoted to meet the needs of recruiters. The use of LinkedIn, Monster, Indeed and other Internet job search services create and sustain a powerful recruiting edge for corporations. Businesses can identify hundreds of high quality resumes and candidates quickly from all over the world in just a few hours or less. Resume scanning programs further refine the candidate list, filtering content by keywords, phrases or other text targets.

HR departments often hide behind Internet screens, offer no phone contact numbers and provide few ways for candidates to follow up with key staff. Without an inside contact, a candidate is left to be a cog in the corporate recruiting machine.

So, workers are faced with a daunting set of economic forces holding their wages down – diminished bargaining units, juggernaut of automation, fewer jobs at merged corporations, temporary jobs in the gig economy, reduced productivity, exorbitant executive pay and corporate control of job markets.

Yet, political forces are emerging to effect changes in the relationship between workers and management that we may expect to see over the next few years. Progressives, worker rights groups and reformers in the US heartland hard hit by the economy are looking to make dramatic changes in the balance between workers and executives.

The Action:

- Place Workers on Boards – as Germany has so effectively setup, engaging management with required representation of workers on Boards.

- End Outsourcing – corporations would pay 50 % tax on each job moved overseas making the move costly, encouraging corporations to move jobs to low cost or inland areas of the US, or innovation economic zones (special tax geographies) and to invest in worker training to receive training tax credits.

- End Low Cost H1-B Visas – the practice of importing inexpensive labor to drive down wages in US markets would be ended.

- Offer Lower Taxes on Repatriated Funds – only if the profits from overseas are invested in productivity actions, increasing wages of workers (not executives), reducing costs or innovation. Stock buybacks or dividends would be prohibited.

- End Stock buybacks – these funds are totally wasted, mislead investors on earnings reports and only serve to increase compensation for executives and shareholders. These funds are better allocated to increase worker wages or increase productivity so workers can receive higher wage increases.

- Breakup Oligopolies – breakup market concentrations in key sectors: information technology, banks and financial services, health insurers, airlines, hospitals and clinics, entertainment, media and distribution and others as deemed in the public interest.

- Balance Job Market Process– require companies over 100 employees to offer information on their website for contacts, phone numbers, job listings with identified contacts, and to let the candidate know the status of his consideration, and candidate introductions held monthly for F2F communication.

- Balance Worker and Executive Pay– tax corporations 25 % surcharge on any corporate income where any executive makes greater than 150 % than any the average worker wage – this would force executives to share their income with workers while not increasing costs. End federal tax deductions on corporate income taxes for executive stock compensation above $1 million. End golden parachute packages by taxing 50 % of every dollar received above $1 million. Severance packages for workers would have to be in proportion to the highest executive package ie, executive receives 10x of monthly salary a worker would receive 10x of his/her monthly salary.

- Fund Worker Training and Increase Wages – for each robot employed, the corporation would be required to offer training, skills development for the displaced worker to find a comparable job within the company or outside. Where automation software or technology is deployed 10 % of the realized cost benefit would be used to raise the wages of all workers in the company.