The View:

While CEO pay is at an all-time high at 290 times average worker pay (vs 20 times in the 1950s), CEOs are boosting their stock incentive base pay by offering corporate bonds (increasing corporate debt) to create cash to make stock purchases. By making stock purchases, they can artificially soak up shares in the stock market, manipulating an increase in share price and thus boost their pay. Corporations are spending $391B year to date ($553B all of 2014) on these stock buyback programs according to Birinyi Associates. Since 2004, corporations have spent $6.9 trillion in stock buybacks and 54 % of their profits over the last decade, according to the Academic Research Industry Network. Between 2006 and 2014, 500 of the highest paid corporate executives received 76 % of their income from stock based compensation. Finally, stock purchases correlate with the surge of the S & P 500 stocks over the past 7 years since the Great Recession, in analysis by Business Insider. Though, for the past few months stock buybacks have fallen off to 2012 levels, which may mean market share prices will fall without these corporate buying programs propping prices up.

What’s the problem with these buybacks? First, executives are putting their corporate viability at risk by borrowing at low interest rates to build cash when at the same time over the past 6 quarters S & P 500 companies have seen a decline in earnings by an average of 3.5 %. As earnings decline combined with debt servicing can cause a future cash flow crunch. Second, they are not spending this cash to make investments in employees, equipment or research and development to increase productivity – which would raise the standard of living and help bring employee pay back into line with the norms prior to the 1980s. Third, this practice is really a form of insider trading (timing not disclosed to average investors) of up to 25 % of daily trading volume. Executives are violating their fiduciary responsibility to shareholders to ensure investments are made for the future viability and growth of the enterprise versus their own financial gain. Fourth, in 1993 the Clinton administration gave companies permission to deduct from corporate taxable income executive pay over $1M if it was linked to corporate performance – stock price. So, in effect we are all subsidizing corporate executive pay, when we pay our fair share of taxes and corporations do not. Fifth, these buybacks are artificially inflating stock share prices, making it difficult for average investors to know what the real price of stocks should be, and creating a market bubble that will eventually burst.

Let’s end corporate stock buybacks:

- Support Senator Tammy Baldwin’s request to SEC Chair Mary Jo White to tighten stock repurchases regulations and to gather stock repurchase information from corporations by writing to the SEC.

- Work with major university endowment administrators to stop purchasing stock of top stock buyback firms including: Apple, Microsoft, Pfizer, Gilead Sciences, Boeing and others, until they eliminate the stock buyback practice (sign a pledge too).

- Identify and develop plans with progressive corporate executives to not perform stock buybacks, and take a pledge not to in the future.

- Run a US financial community PR campaign highlighting the successes of non-stock buyback corporations, identify surrogate spokespersons, and run ‘events’ to keep the topic in the mainstream media to shift the public discourse on stock buybacks.

The Story:

Stock buybacks were viewed by the SEC from 1934 to 1982 as stock manipulation and fraud, with a limit of 15 percent of share volume on any given day, and required disclosure when buybacks were made. In 1982, John Shad, SEC Chairman, was previously the vice chairman of EF Hutton, and the first SEC Chair to be named from the industry in 20 years by President Ronald Reagan. Mr. Shad was a major contributor to Mr. Reagan’s New York campaign. Shad removed these stock buyback restrictions allowing CEOs to perform buybacks in secret, with disclosure only in hard to find filings at the end of the each quarter. In that year, the SEC adopted rule 10b-18 which holds corporations harmless from allegations of stock price manipulation due to stock repurchases. Plus, conformance is voluntary and does not require repurchase data reporting! Voluntary reporting was noted by the current SEC Chair Mary Jo White to Senator Tammy Baldwin in a reply to an earlier request for increased policy enforcement of stock purchase regulations.

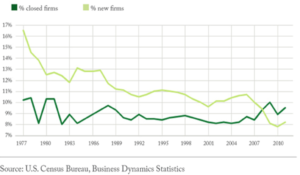

There is a correlation with stock purchases by corporations and stock market performance. This chart that appeared in Business Insider shows a correlation that is hard to miss (right click to enlarge image):

While, it can be argued that stock buyback purchases are not the only factor driving the market (Federal Reserve keeping interest rates near zero is another), certainly to any reasonable observer the pumping of $6 trillion dollars into the stock market since 2004 and 54 % of corporate profits of S & P 500 corporations has to have some impact.

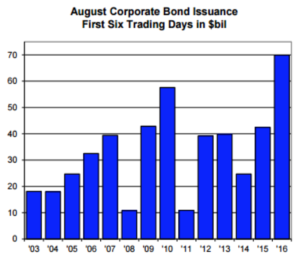

Earnings are fading, at an average of – 3.5% per quarter for the last 6 quarters. So, where do corporations get the cash to do stock buybacks? By issuing corporate bonds, which in the month of August have hit a new record high for just the first six days of the month at $70 billion, when an in an average month is $125 billion. Here is a chart on the just the month of August compared to past years ( right click to enlarge image):

So after getting the cash they need, CEOs perform stock buybacks and get well compensated for doing so. The pumping up of stock prices to increase executive pay is a standard executive compensation practice, some examples are particularly capricious. Pfizer CEO, Ian Read between 2011 and 2015 enjoyed $76.8 million in compensation, of which 63 % was in stock shares. During this time Pfizer made $44.7 billion in stock buybacks. For the same period Pfizer only paid $16 billion in US income taxes. This $44.7 billion is not invested in research, development, cost reductions in operations or employee pay – instead is used for stock price manipulation. It is not hard to fathom given the magnitude of the miss application of investments that more effective and productive investments would benefit all patients, employees, stockholders and give us lower drug prices! Plus, the US government would have more tax generated funds if a provision adopted in the Clinton administration in 1993 were eliminated to allow corporations to to deduct from corporate taxable income executive pay over $1M if it was linked to corporate performance (stock price). Finally, when executives allocate resources that benefit only themselves and a few shark investors, they are acting in violation of their fiduciary responsibility to all shareholders, employees, customers and the public to focus on ensuring the future growth and development of the enterprise.

Some industry observers see the perils of stock buybacks to the stock market and economy. Ben Silverman, VP of Research at Insider Score, that tracks buybacks says that buybacks mask managements’ inability to grow the business and be innovative thinkers. Professor William Lazonick, University of Massachusetts, further observes that buybacks have the potential to push the economy into a recession, as companies are using stock buybacks to boost share prices instead of investing in their business for future stability and long term growth.

What should be done about stock buybacks by corporations? Professor William Lazonick, recommends that we recognize that the ‘safe harbor’ provision 10b-18 is really a shelter for stock manipulation. He suggests the provision be repealed. Agreed. Let’s take stock price manipulation by corporate executives out of the markets so we can have a fair stock market setting prices on real demand and supply, rather than price set by corporate manipulation. Since July of 2015, Senator Tammy Baldwin has been working on this issue with SEC Chair Mary Jo White.

The Action:

- Support Senator Tammy Baldwin’s request to SEC Chair Mary Jo White to tighten stock repurchases regulations and to gather stock repurchase information from corporations by writing to the SEC.

- Work with major university endowment administrators to stop purchasing stock of top stock buyback firms including: Apple, Microsoft, Pfizer, Gilead Sciences, Boeing and others, until they eliminate the stock buyback practice (sign a pledge too).

- Identify and develop plans with progressive corporate executives to not perform stock buybacks, and take a pledge not to in the future.

- Run a US financial community PR campaign highlighting the successes of non-stock buyback corporations, identify surrogate spokespersons, and run ‘events’ to keep the topic in the mainstream media to shift the public discourse on stock buybacks.