After the recent NY Times op-ed by Senators Bernie Sanders and Chuck Schumer to require corporations share profits with workers before stock repurchases, there has been a lot of confusion about how stock buybacks work and their impact on the economy. Let’s clarify how share buy backs work first.

Corporate stock is bought and sold in open markets between a buyer and seller. On any one day the share price moves up or down depending on the demand for shares between a buyer and seller. Corporate executives can manipulate the price of shares by reducing the pool of shares on any trading day, according to SEC rules up to 25 % of the daily volume and not executing a repurchase within the first 30 minutes of the open or the close. If shares are taken off the market on any one trading day, posted to the books of the company those shares are effectively taken out of the market and if demand stays the same the price goes up. Of course, the share price can go down as well, if demand drops on the repurchase day.

Stock buybacks cause misleading reports on earnings per share. A simple example, if Gigantic HiTech has profits of $1 million for the quarter and 1 million shares are outstanding in the market, then the EPS is $1.00. However, if the firm purchases 100,000 shares during the quarter and takes them off the open market the total number of outstanding shares is reduced to 900,000 artificially boosting EPS to $1.11 or 11 %. The company has not increased profits during the period they have just reduced the number of shares outstanding and report the EPS figure in non GAAP reports. GAAP reporting requires EPS be calculated on the number of outstanding shares before repurchase.

So, the dollars spent on stock share repurchases do not go into ‘jobs, the economy or re-invested’ the money is spent on goosing stock prices. The SEC in 1982 prior to the Safe Harbor policy that allows for stock repurchases called corporate stock repurchasing ‘stock price manipulation’. From 1982 to today the policy allowed corporations to execute market stock purchases and not be held liable in shareholder lawsuits for price manipulation. Plus, companies only had to report open market purchases each quarter voluntarily. Effectively, the SEC gave companies the green light to drive stock prices anyway they wanted. Just because time has gone buy that does not change the manipulative character of the stock repurchase practice.

How big a problem is it? Goldman Sachs estimates that $940 billion stock repurchases were made in 2018, and they continue to forecast a similar figure for 2019. Major players in FAANG stocks repurchase billions of dollars of shares supporting stock prices. Forbes estimates that Apple spent $100 billion in share repurchases in 2018. CNBC calculated a year ago that Apple share prices were inflated by as much as 20 %. Between 2015 through 2017 S & P companies spent 60 % of all profits on stock buybacks, according to Forbes.

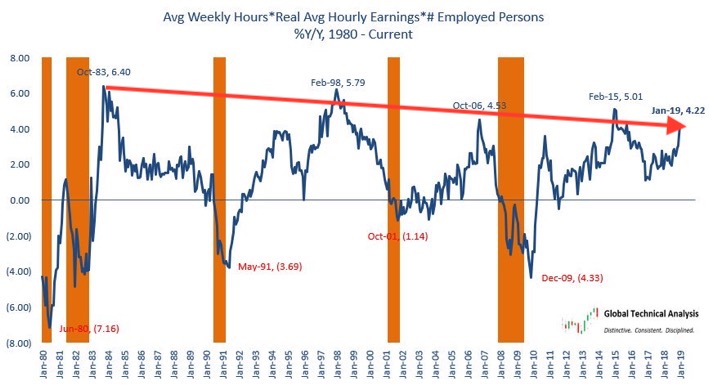

So, where else could they be spending the money instead of driving stock prices up and increasing the compensation of executives? On employee wages, but wage increases are not happening, interestingly since 1982 when the SEC Safe Harbor provision went into effect real wages have declined.

Real wages after inflation have continued to decline when allocated across all persons employed. Bankrate surveyed 1,000 workers at all income levels last year finding only 27 % received raises. Corporations are not increasing wages even to keep up with inflation.

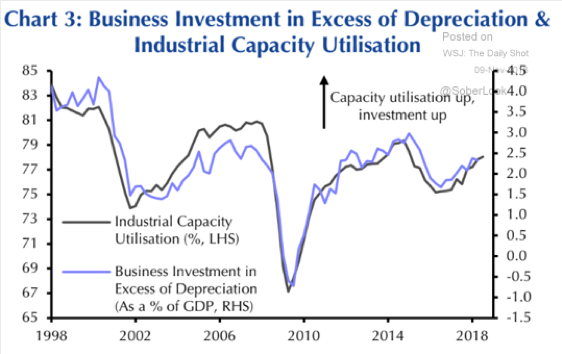

What about capital expenditures are they up? No. With all the pronouncements of executives that they are investing in their companies to increase innovation and productivity they are in fact not performing, here is the analysis of business investment as percent of GDP since 1998:

Note the declining business investment line in the chart from 4.5 % of GDP in 1998 to 2.5 % in 2018, a 44 % reduction.

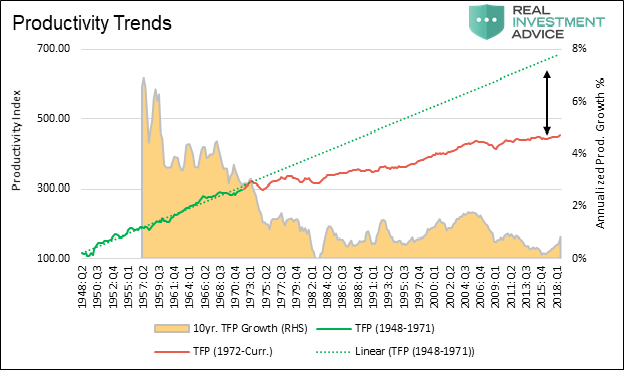

Maybe corporations are still increasing productivity anyway so they can afford to do stock repurchases? No. Productivity continues to stall. The following chart shows total factor productivity (TFP) since 1948, the long term average is the green line from 1948 to 1971 versus 1972 to today red line today, plus growth in productivity is close to zero:

Executives have made decisions about how to allocate profits that are not increasing productivity, raising wages, hiring workers or reducing prices. Our economy and our workers are the losers while executives and the wealthy elite who own stocks profit from these short term decisions.

Next Steps:

Do executive decisions on profit allocation really affect workers and consumers? Yes.

GM last year announced the closing of their Lordstown plant and the layoff of 15,000 workers due to a shift in consumer buying to trucks and misallocated investments in poor selling product lines. Yet, since 2014 GM spent $13.9 billion in stock repurchases according to the Wolf Report. GM could have spent that money on employee training, shifts in product development, the phased closing of plants and phased in building of new plants and likely would not have had to resort to massive employee layoffs.

Mylan announced 18 months ago a 584 % increase in the price of EpiPen’s used in life – death situations to counter act food allergy shock. At the same time Mylan executives took care of themselves first with over $1 billion in stock repurchases to drive stock prices up. Analysts evaluated the product cost of goods and assembly for EpiPens and estimated it cost Mylan about $2 billion to manufacture, so the $1 billion could have gone toward reducing the cost of the EpiPen by 50 %.

In both examples corporate executives took care of themselves first, and their employees or patients second. This profligate management of profits from customers and patients was not allowed prior to 1982. Corporate executives have a social and ethical responsibility to allocate funds in the balanced interests of the company, employees and the community

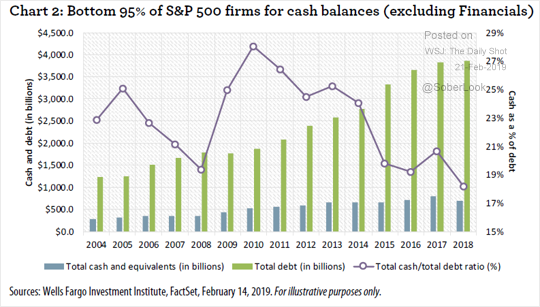

Executives are executing stock buybacks at the cost of sound financial management as well. The debt to cash ration of S & P 500 corporations is at 18 %, a lower level than at the 2008 recession. When the economy slows corporations will be squeezed between debt loads, operating costs and low cash reserves.

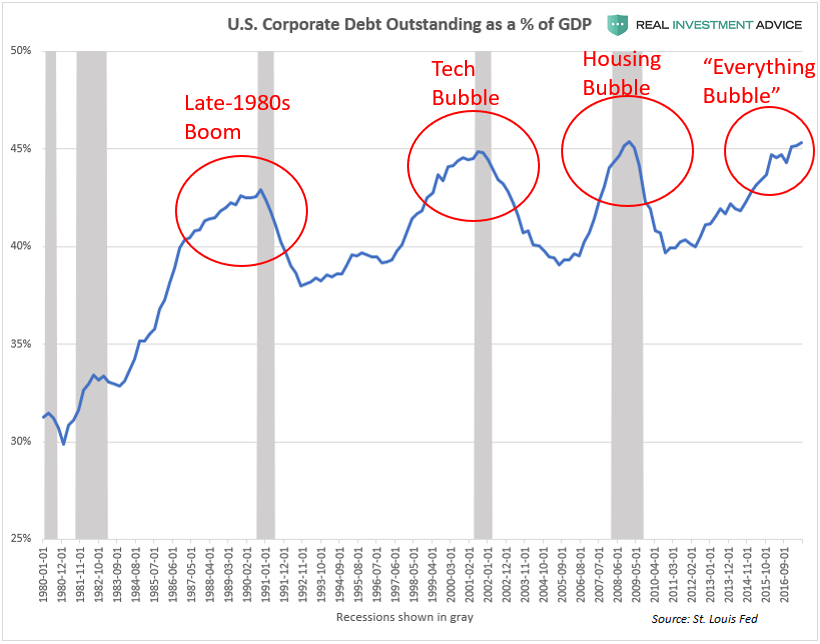

Our economy continues to decline as GDP shrinks year over year, in part by trillions of dollars being wasted on stock repurchases instead of being invested in worker training, wages, capital equipment and research and development. A trillion dollars is 5.26 % of the U.S. economy shifting buy back dollars could have a huge impact. Corporate executives have magnified the problem by borrowing money at low interest rates to keep stock repurchases going even when profits lag. Today, corporate debt is 45 % of GDP at all time high inflating the economic bubble.

A reduction in corporate borrowing to inflate stock prices would go a long way toward putting the economy on a more solid business foundation. A major SEC policy shift ending stock buy backs would need to be phased in as a percentage over several years to allow markets to adjust, yet if we are to build an economy that works for all we need to end this misleading, damaging and costly practice.